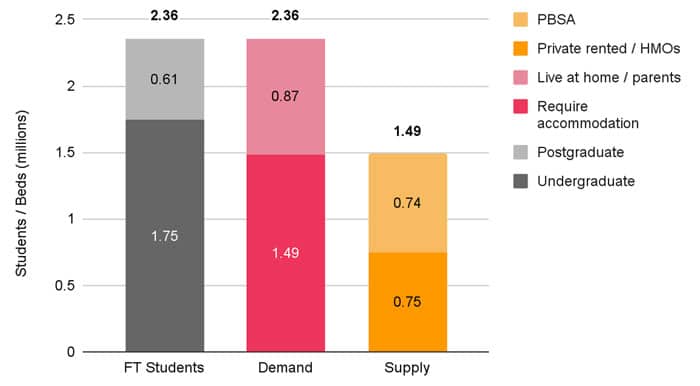

In 2022/23, only about half of student housing demand in the UK was met by purpose-built student accommodation (PBSA). That rather telling statistic was shared by Karen Best, head of accommodation at PwC, during a featured panel at the ICEF Monitor Global Summit. Ms Best drew on PwC’s recent research in the field, alongside its insights into the financial condition of higher education institutions, to conclude that PBSA stock was likely to continue to lag behind student demand going forward.

Ms Best went on to outline that, of the roughly 740,000 PBSA beds in the UK, just under half (44%) are owned and operated by the universities themselves. The remaining 56% are privately owned and operated.

She believes as well that private investment is the more likely path to building capacity in terms of student housing: “Given the current and likely future financial pressures that the sector faces in the UK, there will continue to be constraints on all universities, even the largest, most reputable, and financially strong ones,” she explained. “This is causing universities to prioritise [capital spending] in [academic programming]. I expect to see universities looking for further support from the private sector to deliver new beds and to support refurbishing of a lot of the university-owned stock…While there are and will continue to be new PBSA developments, the ability to deliver affordable accommodation in the places it is needed most continues to be a challenge.”

The affordability dilemma

The panelists all agreed that housing costs remain a significant issue for students. While price inflation has eased somewhat in the UK this year, there have been significant price hikes in the years following the pandemic.

“We’ve seen huge increases in pricing over the last couple of years, including some double-digit increases in some cities last year, which is quite staggering,” noted Ms Best.

Meanwhile, Hannah Chappatte, the founder & CEO of Hybr reported that there has been a huge rent increase this year in the HMO market (which refers to privately owned housing, a shorthand for which is HMO, or “a house in multiple occupation”). She noted as an example the case of Bristol where, “What we saw was that a lot PBSA developments were paused because of the impact of COVID. So the HMO market had a heyday over those two or three years where a lot of students that would have gone into PBSA went into the HMO market. And we saw consistently rents increasing by 15% year on year.”

The panel discussion revealed that there is a lot of nuance and granularity in the student housing market, and that you cannot measure the health or balance in the market simply by counting beds and heads.

“It can lead you down the wrong track if you are looking at here is how many rooms there are and this how many students there are,” said Ms Chappatte. “Really, you have to break it down into segments: this is the type of student, this is their budget, this is what they are looking for, and this is the type of accommodation we have in each city. Often you will see that it is not just a ‘rooms’ issue, it all comes down to price. It all comes down to budget and that is what we have to tackle: thinking creatively around how can we build more affordable units; not just more rooms.”

Not just how many but where

In spite of continuing strong student demand, PBSA stock continues to lag considerably behind demand in many study destinations due to a number of factors, including delays in the building planning process, labour shortages, and inflation in construction costs. Another inflationary impact for developers is the relatively high cost of financing in a climate of rising interest rates.

Ms Chappatte made the case that international education needs to draw lessons from other industries in its search for solutions. “We need to give investors conviction around how they can build and develop affordable units,” she said. “In our sector, we need to look at hospitality because hospitality has done that really well, You have Travelodge and Premier Inn that are really affordable brands that are also huge drivers of revenue. So why can’t we have the same in the residential sector where we have more self-service, more self-managed types of just rooms rather than these amenity spaces? I think there is so much that we can do [in that area] and that we are still so far behind in terms of residential versus hospitality.”

The panel acknowledged that prices typically fluctuate according to local supply and timing of booking — with the best rates being available for advance bookings and with prices tending to increase the close the student gets to programme start. This can be offset, however, in cases where local supply increases, causing prices to soften.

But the discussion also revealed that price is closely connected to location in student decision making. Ms Chappatte adds, “We’ve done a number of focus groups this year and rent is number one and location is number two, in terms of what [students] are prioritising in their search.” We can understand as well that that trade-off is carefully made and students definitely weigh proximity to campus very seriously in their decision.

Who is responsible?

The panelists also stressed the need for more and better collaboration between institutions, developers, students, government, and community stakeholders in order to boost local housing stocks.

“Universities need to speak to accommodation providers more,” concluded Arunima Dey, research manager with The Class Foundation. “How many students are they expecting? How many beds do they need? But it’s also extremely hard to build sustainable, future proof housing and provide all those amenities that students appreciate and keep rents affordable. [So we] need incentives for developers and investors in order for them to have a varied portfolio, and those incentives essentially needs to come from municipalities and [other levels of government]. Students are seen as a transient group but if there is more student housing than there is also more housing for all other demographics as well.”

She added, “For example, one of our partners, RESA, is a private PBSA provider in Spain. They [set a target] of having 70% of their beds to be affordable beds. They are able to do so because they have good ties with universities and with the city government. Operators and investors in the current climate cannot just do it by themselves.”

For additional background, please see:

Source