Students looking for English-taught online degree programmes now have more options than ever. A new report from British Council and Studyportals shows that the number of online English-taught programmes (ETPs) has increased by 123% since 2019. The report is entitled Mapping English-taught Programmes Worldwide.

Which countries offer the most online ETPs?

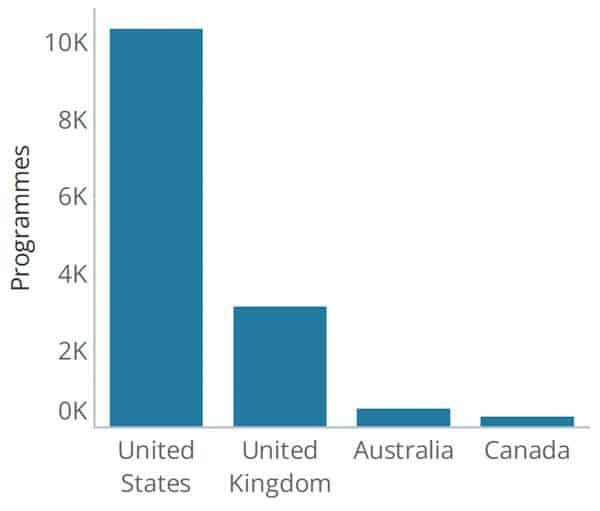

The vast majority of online bachelor’s and master’s programmes are offered in Australia, Canada, UK, and US (92%). The UK and US are by far the biggest suppliers of the four, offering thousands of ETPs versus under 500 in Australia and Canada. Together, the rate of online ETP expansion in Australia, Canada, UK, and US since 2019 is 126%.

The supply of online ETPs is increasing quite quickly outside of the Big Four as well, with a doubling of growth since 2019 (from 623 to 1,212 in 2023, an increase of 94%).

Megan Agnew, IELTS Global Partnerships at British Council said:

“This report highlights that, while the Big Four markets continue to dominate the landscape of online programmes, the overall shifts in English as a Medium of Education provides international students with more choice and flexibility than ever before. Ensuring standardised frameworks in both policy and assessment, whether in on-campus or online programmes, is critical in ensuring students can access valuable educational experiences in their chosen location.”

While interest in online programmes dissipated somewhat after the pandemic – because international students embraced the opportunity of learning face-to-face for the first time in months (or even years) – it is picking up again. International students are faced with high costs of travel and rising costs of study/living in leading destination countries. For these reasons as well as more restrictive immigration environments in Australia, Canada, and the UK, online learning is becoming a real option for students who might otherwise have preferred to travel.

Another important audience for ETPs are students who like blended learning. A 2022 McKinsey survey of 7,000 students found that 65% wanted to retain some aspect of online learning, citing reasons such as flexibility and convenience.

Top levels and subjects

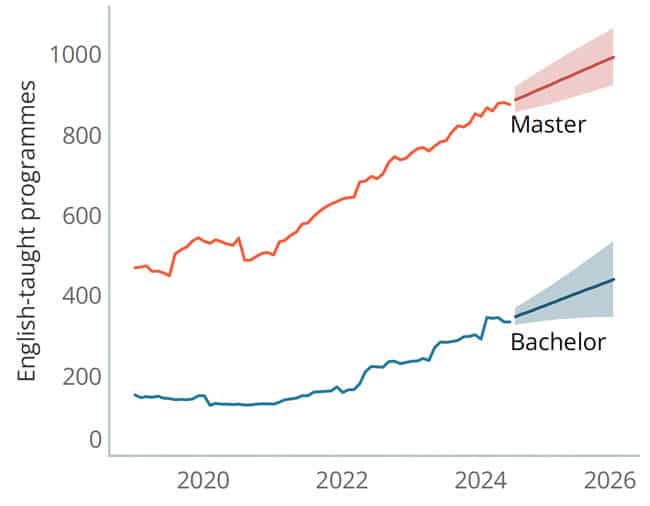

Growth is occurring at both the undergraduate and graduate levels, and as shown below, this is expected to continue through 2026.

At the bachelor’s level, Applied Sciences and Education & Training are expanding the fastest of all online ETPs (+1,000% and +700%, respectively), while arts and design-related programmes, law, and journalism are either stagnant or declining. At the master’s level, the fastest growth is occurring in Computer Science & IT (+181%), Business & Management (+137%), and Hospitality, Leisure & Sports (+135%), while provision of Education & Training, Journalism & Media, and Law online programmes is declining.

Expansion outside the Big Four

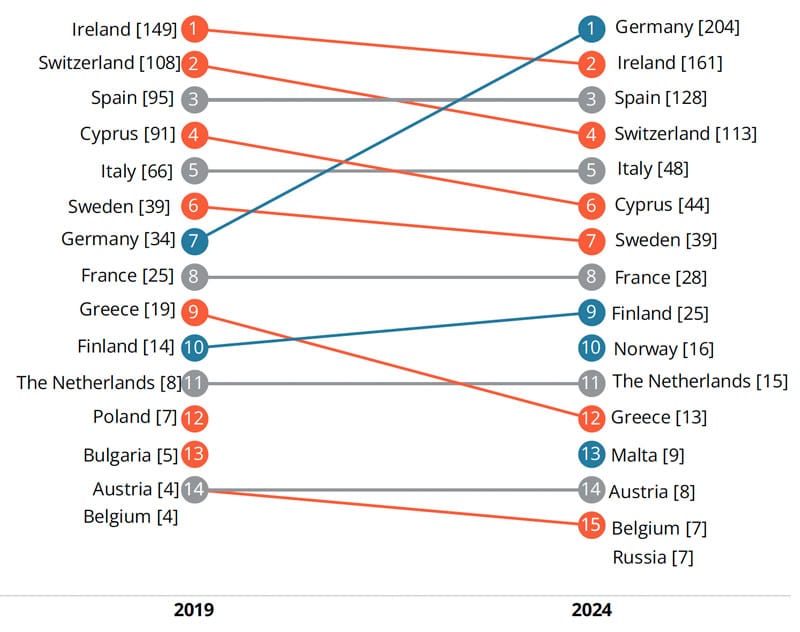

Europe’s Higher Education Area (EHEA) accounts for 68% of non-Big Four online ETPs, with Germany, Ireland, Spain, and Switzerland the leaders. Germany, in particular, is quickly catching up to Canada and Australia: in 2019 Germany offered 34 ETPs, while in 2023 it offered 204. Canada offered 271 and Australia 471 In 2023.

Provision is also growing in regions including Africa and the Middle East – notably in South Africa, the UAE, and Jamaica – while online options are notably scarce in Asia.

Online learning as a complement, not a threat

Edwin van Rest, cofounder and CEO of Studyportals, said:

“We clearly see that these online programmes primarily give access to a different segment of students who may otherwise miss out on higher education: adult learners, flexible learners, people with different learning styles/preferences. It is a misconception that online programmes are a threat or a competitor to on-campus programmes. Online education is poised to drive a more inclusive and dynamic future for international higher education, stimulate Lifelong Learning and increase the flexibility of labour markets.

While Online English-taught programmes are still predominantly a niche strategy for only a part of institutions, and is more developed in the Big Four destinations, it is good to see other markets starting to catch up with phenomenal growth in relative terms. With anti-immigration sentiment rising in many markets, it is also a pathway for institutions to make their internationalisation strategy less dependent on visa and/or accommodation restrictions.”

For additional background, please see:

Source