By Kelvin Obambon

Payment system innovations and financial inclusion were key highlights at the Central Bank of Nigeria (CBN) Fair held in Calabar, Cross River State, on Thursday, October 9, 2025.

The Fair which focused on the theme “Driving Alternative Payment Channels as Tools for Financial Inclusion, Growth and Accelerated Economic Development,” showcased the CBN’s commitment to enhancing financial inclusion and improving payment systems across Nigeria, particularly targeting underserved communities.

CBN Governor, Olayemi Cardoso, in his address, highlighted the bank’s efforts to stabilize the economy and foster financial growth, stating that “The Management of the Bank remains firmly committed to fostering productivity, enhancing financial inclusion, and maintaining monetary and price stability.”

READ ALSO: Calabar rent hike sparks calls for control

Cardoso who was represented by Uche Tobias, Assistant Director, Corporate Communications Department, enumerated key initiatives including exchange rate unification, bank recapitalization, the non-resident BVN system, and the Nigeria Payment System Vision 2028 aimed at accelerating digital transformation.

Earlier in his welcome address, Cross River Branch Controller of CBN, Jibunoh Nwanneamaka, stressed the importance of alternative payment channels, stating that “Alternative payment channels such as Mobile Money Platforms, Agency Banking, USSD Services, Internet Banking, Point of Sale Terminals, Contactless Payments, and Digital Wallets, are not just conveniences but lifelines for millions of Nigerians, especially in underserved communities.”

Represented by Jude Nwafor, Head of Research, the branch controller urged attendees to leverage these innovations to deepen financial inclusion and economic participation.

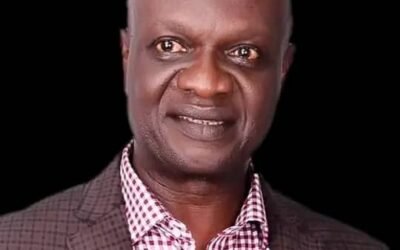

Also speaking, President of the Calabar Chamber of Commerce, Kelly Ayamba, praised the timing and relevance of the fair. He declared that “Financial inclusion helps economic growth. It also helps personal business growth for those who are providing these services.”

Ayamba urged all stakeholders to support the CBN’s goal of achieving near-universal financial inclusion by 2030 and highlighted the need for public awareness on financial safety against scams and Ponzi schemes.

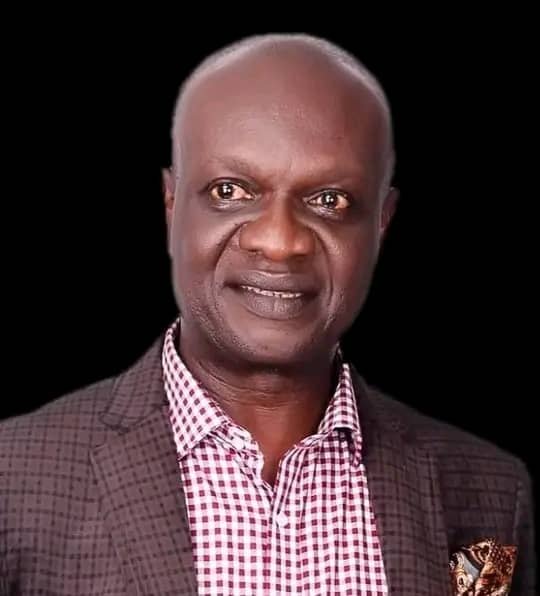

On his part, the Senior Special Adviser on Agriculture to the Governor of Cross River State, Prof. John Shiyam, applauded CBN’s efforts to connect farmers in remote areas to financial services. He explained that “Funding and financing agriculture and for farmers to access credit is a big challenge.”

Therefore this initiative, according to him “is going to be very beneficial for farmers to be aware of the available alternative payment methods they can leverage in their farming activities.” He also acknowledged the CBN’s role in facilitating agricultural development funding through partnerships and highlighted its significance to the state’s economic priorities.