The following article is adapted from the 2025 edition of ICEF Insights magazine, which is freely available to download now.

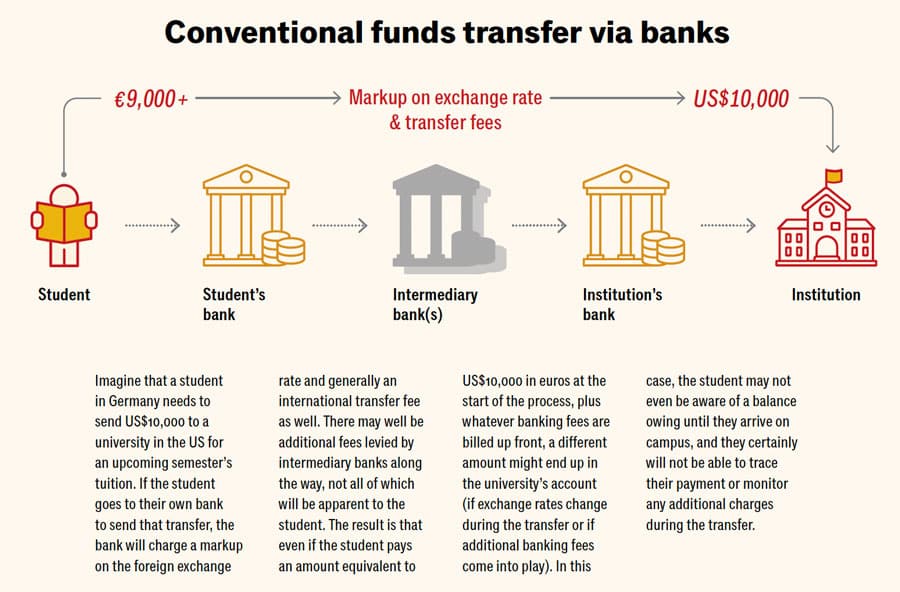

There is a story, famous in some circles, about an international student who once sent US$53,000 to an Ivy League institution in the United States. But something went wrong: the university received the payment, but then it got lost. The university apparently did not have a way to connect the payment to the student who sent it.

Can you imagine the extra work, stress, and confusion that followed? Because the transfer was not attributed to the student at the time of payment, the student spent a difficult few weeks trying to demonstrate that they had, in fact, paid their fees.

That is an admittedly extreme example, but variations on it are common. Consider the hundreds of thousands of students studying abroad today, and you quickly understand the importance of making it simpler for students and families to pay fees across borders, currencies, and financial systems.

The point at which a student makes a payment is a crucial step towards their enrolment, but it is one that often doesn’t get enough attention. In fact, if you don’t make it simple enough for students to transfer fees to your institution, you may be sacrificing student recruitment and retention.

Financial transactions are part of the student experience

The number of institutions that have been grappling with this problem explains why a new category of payment services designed for the international student sector is expanding rapidly. Service providers in this space – such as Flywire, Convera, EbixCash, Vavita, Flutterwave, TransferMate, and NexPay – harness technology and expertise in foreign exchange and financial systems to offer students and their families more affordable, faster, and easier ways to transfer funds abroad.

“When we started, the international student was completely neglected in terms of institutions understanding [these students’] payment experience,” says Flywire executive vice president of global education, Sharon Butler.

“[Institutions] didn’t know that students climbed mountains and swam rivers to get payments to them. You think about all of the investment that people make in marketing and recruitment, but that last step, the payment, is often overlooked.”

Localisation is key

The goal is to reduce the complexity of moving money from country to country. Ms Butler explains: “If it is really going to be a great experience for families, it has to be localised to that market. We need to allow them to pay with something that is familiar. If it is easy and familiar, that is a great experience.”

Localisation can take many forms. For example:

- A Chinese student who routinely uses Alipay Wallet might also want to use Alipay to pay international school fees.

- The parent of an Indian student who needs to file tax declarations when making overseas payments might appreciate a payment process that provides them with those documents and prompts them to complete and file them.

Beyond transfers

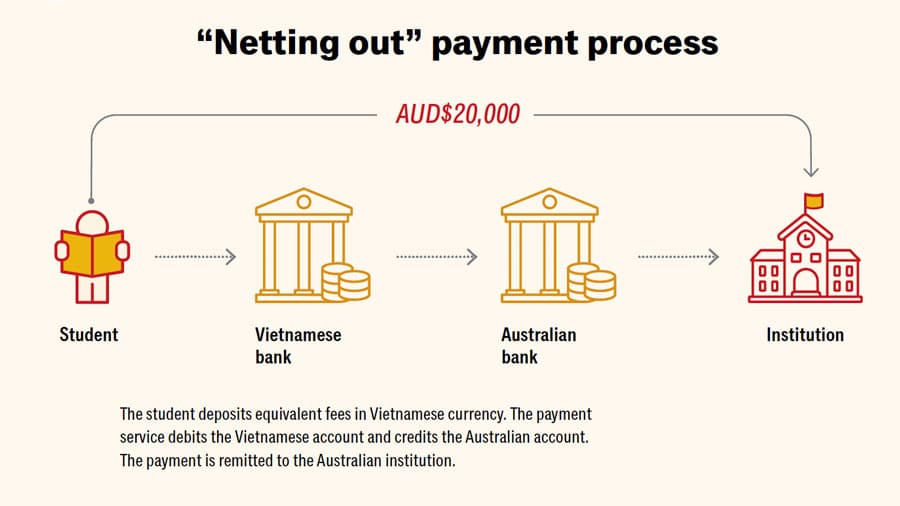

New systems can also eliminate the need to transfer funds between countries, by instead “netting out” funds across foreign currency accounts operated by payment service providers.

NexPay CEO, Piew Yap, explains:

“Say a student in Vietnam wants to send AUD$20,000 to a university in Australia. Instead of a traditional wire transfer, we leverage our network of held funds in multiple countries. For instance, if we have sufficient AUD funds in Australia, we simply debit the equivalent amount in VND from our local account in Vietnam and credit the university’s account in Australia with AUD$20,000. This minimises transfer times, reduces transaction costs, and avoids the complexities of cross-border remittances.”

Speed matters

Speed in payment processing is another top goal for every payment provider, and reconciliation – which is the critical step of verifying payment X was made by student Y – can often slow things down. Many experts see blockchain technology as a solution.

“I believe blockchain technology will revolutionise the foreign exchange business,” says Mr Yap. “One of the most significant impacts is the potential for near-instant settlement times, eliminating the traditional delays associated with cross-border payments. Additionally, the decentralised nature of blockchain can reduce the risk of fraud and improve the overall security of transactions. As blockchain adoption grows, we anticipate a more efficient and streamlined foreign exchange market.”

[Editor’s note: A blockchain is a distributed database shared across a computer network. Because there is no way to change a block, the only key point of trust in the system is the point where a user [or computer program] enters data. This reduces the need for trusted third parties along the way, thus improving transaction time and costs.]

That speed of processing is more than just a matter of customer service or expedited reconciliation. It can also affect how quickly students can receive admissions documents to support visa applications, be eligible to register for courses, and arrange housing.

Set exchange rates

Much reporting and reconciliation is automated within specialised payment systems, and this opens the door to new payment models, such as instalment programmes.

“We offer flexible payment plans to accommodate the financial situations of students,” says Mr Yap. “For example, a student might choose to pay their tuition fee in up to 48 instalments [in advance of programme start], with the exchange rate set at the beginning of the payment plan. This allows them to manage their cash flow more effectively, knowing that their rate won’t change throughout the period.”

Simple solutions

Sending funds internationally has always been a complex business with significant compliance and regulatory requirements and many other moving parts. Not everything can be simplified, but specialised payment services are making transactions easier, faster, more affordable, and more transparent for students, parents, agents, and institutions alike.

As such, they represent an important new lever for improving international student experience and satisfaction by reducing transactional friction.

For additional background, please see:

Source