In his October 2023 address, Hong Kong Chief Executive John Lee set out some ambitious goals for the territory’s foreign enrolment, including that Hong Kong would, “Double the quota for non-local students in subsidised post-secondary institutions to 40%, and strengthen scholarships and related supporting facilities to attract more foreign and mainland students to study in Hong Kong.” For comparison’s sake, the current non-local enrolment in Hong Kong was roughly equivalent to 25% of total post-secondary enrolment as of 2022/23.

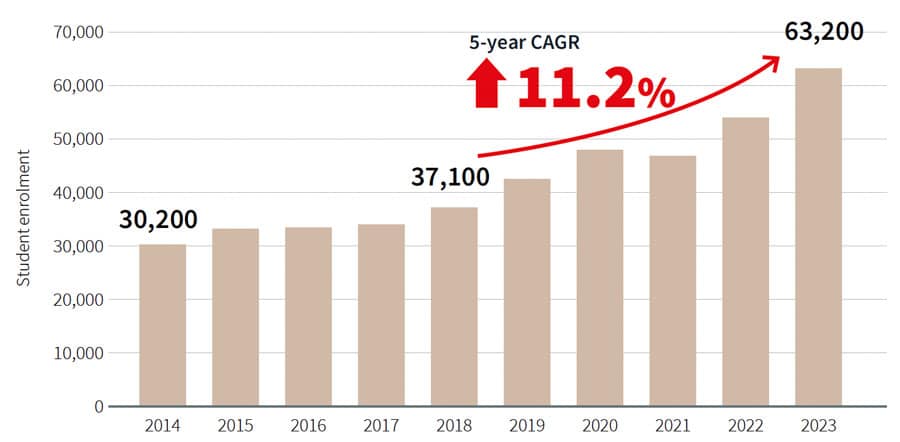

However, a new report from real estate services firm JLL Hong Kong makes the point that the territory also needs to seriously factor an expansion of student housing in those plans. Unlocking student accommodation market potential in Hong Kong projects that non-local enrolment in Hong Kong higher education will reach 92,000 by 2027/28, up nearly 50% from 2022/23. Much of that growth will because, “Hong Kong is drawing increasingly more students from mainland China and across the globe,” as home to five of the world’s top 100 universities, and, JLL expects, it will attract increasing private investment in expanding student housing stock.

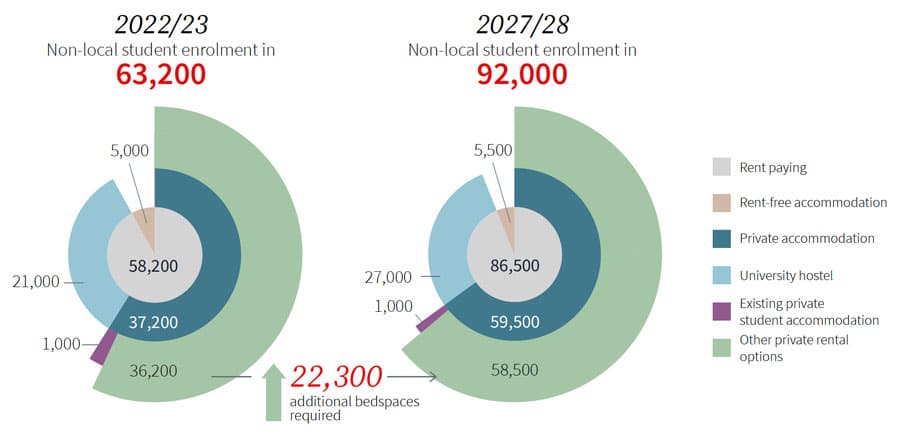

JLL estimates that 37,200 non-local students currently opt for private housing during their studies – a figure that is projected to grow to nearly 60,000 within the next four years.

The following graphic illustrates the current (2022/23) and projected breakdown of non-local enrolment by housing type, and indicates an estimated shortfall of more than 22,000 student beds by 2027/28.

That growing demand on available housing stock, and the looming housing crunch that it suggests, is in turn fuelling real upward pressure on rental rates.

“Rental prices in Y83, the largest private student accommodation in the city, recorded an annual growth rate of over 10% since 2022. We observed that the rents of private student accommodation are soaring at an accelerated pace in the last 12 months and reached 15%, the highest [rate of increase yet],” said JLL’s Head of Capital Markets Oscar Chan. “Residential rents have increased by 7.0% since the borders reopening in early 2023, while the room rates of hotels also increased. The rents of private student accommodation are expected to grow further as the demand for student accommodation is currently underserved and the population of non-local student is growing rapidly. Private student accommodation will be a new investment property asset”.

The report makes it plain that the growing supply-demand gap in housing could put a serious curb on Hong Kong’s plans to expands its non-local student base: “The overheated leasing market, coupled with escalating rents, poses a significant challenge to finding suitable and affordable private accommodation. The scarcity of reasonably priced good quality accommodation options could dissuade international students from selecting Hong Kong as their preferred destination for higher education.”

In all of these respects, Hong Kong is repeating the lesson learned by so many other destinations in recent years: that any goals for significant growth in international enrolment have to be accompanied by a similar expansion of student housing stock.

For additional background, please see:

Source