Vice President Kamala Harris’ presidential campaign recently said she supports a proposed policy aimed at the ultrawealthy that President Joe Biden has pushed for years: a new tax on unrealized capital gains, or unsold assets that have increased in value.

But some social media users exaggerated how such a tax would affect the majority of Americans.

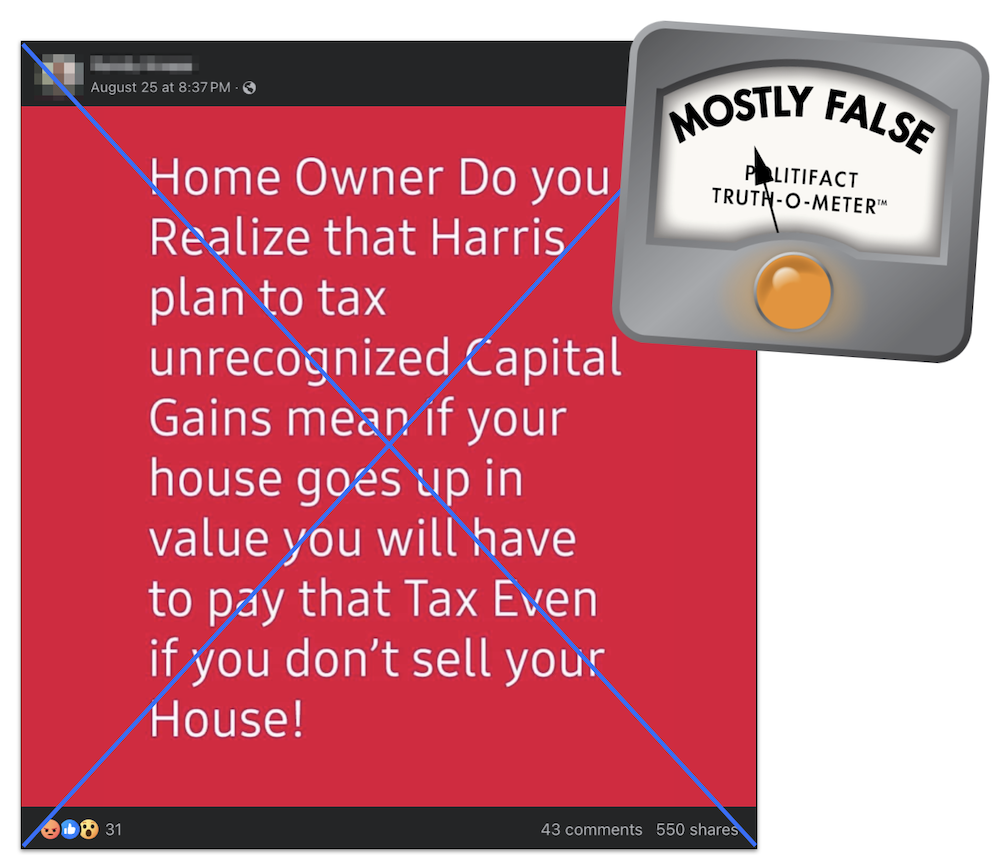

An Aug. 25 Facebook post read, “Home Owner Do you Realize that Harris plan to tax unrecognized Capital Gains mean(s) if your house goes up in value you will have to pay that Tax Even if you don’t sell your House!”

(Screengrab from Facebook)

Another Facebook post showed a photo of a Fox News segment about Harris’ tax plan with the words “unrealized gains tax: 25%; currently: 0%” circled. Below that, text on the photo read, “This means they will tax you for the house you own extra every year!”

Other posts on Facebook and Threads made similar claims about the proposed tax. They were flagged as part of Meta’s efforts to combat false news and misinformation on its News Feed. (Read more about our partnership with Meta, which owns Facebook, Instagram and Threads.)

Harris’ opponent, former President Donald Trump, said at an Aug. 23 campaign rally in Las Vegas that this unrealized capital gains tax “will soon be applied to small business owners and you will be forced to sell your restaurant immediately.”

Harris’ official campaign account, Kamala HQ, responded on X that the tax would apply only to people with $100 million in wealth.

How would Harris’ plan to tax unrealized capital gains work?

Harris has not released any tax policies. Harris’ campaign said she supports tax provisions in Biden’s 2025 budget proposal, including a tax on unrealized capital gains, Axios, The New York Times and The Wall Street Journal reported.

When PolitiFact contacted the Harris campaign for more information about Harris’ tax plan, the campaign declined to comment, pointing instead to reporting from Axios and Minneapolis-based news outlet KMSP-TV.

Biden’s budget proposes tax hikes for the wealthiest Americans; it would not raise taxes for people earning less than $400,000 a year.

One of Biden’s proposals is a 25% minimum tax on income, including unrealized capital gains, for taxpayers with a net worth — meaning assets minus liabilities — of more than $100 million.

If instituted, the White House said, this so-called billionaires tax would apply only to the wealthiest 0.01% of Americans — not the vast majority of the country’s taxpayers. In the U.S., there are about 9,850 centimillionaires, or people with at least $100 million in wealth, according to a March 2024 report from Henley & Partners, a wealth and migration advisory firm, and New World Wealth, a global wealth research firm.

So, of this small ultrawealthy group, only the people who have more than 20% of their wealth in tradable assets — for example, publicly traded stock — would pay taxes on unrealized capital gains, Biden’s budget proposal states.

Taxpayers with more than 80% of their wealth in nontradable assets, such as real estate and shares in private startups, would be considered “illiquid.” These taxpayers could choose to include only unrealized gain in tradable assets when determining how much they owe in taxes, according to the budget proposal.

Currently, capital gains are taxed only after a realized event, such as when someone sells an asset. If an asset remains unrealized — never sold — it’s not subject to taxes.

Some economists said an unrealized capital gains tax would promote more equity in the tax code.

“As it is now, normal workers are taxed on their entire income, but we have a situation where the very rich can have hundreds of millions or even billions of dollars of capital gains which go altogether untaxed,” said Dean Baker, co-founder and senior economist at the Center for Economic and Policy Research.

Wealthy people can hold stocks until they die, and then pass the assets to their heirs without paying taxes as long as their gains are unrealized, Baker said.

Biden’s budget proposal argues that tax-free accumulation of wealth over generations exacerbates income-and-wealth disparities in the U.S.

Adam Michel, tax policy studies director at the libertarian Cato Institute, said an unrealized capital gains tax would overly burden the Internal Revenue Service and would discourage investment in burgeoning businesses.

“Such a system would encourage investors to put their money in safer investments, such as government bonds, rather than new innovative industries, like new energy sources, biopharmaceuticals, or AI,” Michel said.

Economic experts told PolitiFact that this proposed tax change is not certain, even if Harris wins the presidency. Any changes would require congressional approval, and control of the House and Senate will also be decided in November.

It’s also unclear whether a wealth tax, such as this one, would survive legal challenges.

Our ruling

Social media posts claimed Harris’ “plan to tax unrecognized Capital Gains mean(s) if your house goes up in value you will have to pay that Tax Even if you don’t sell your House.”

That claim ignores several critical facts about Harris’ plan, which is derived from Biden’s 2025 budget proposal. Most crucially: Most Americans wouldn’t have to pay a tax on the appreciated value of their unsold assets and this tax would apply only to people with more than $100 million in wealth. That’s fewer than 10,000 people in the U.S.

Although this tax would affect the country’s top 0.01% of taxpayers, the claim that American homeowners, broadly, would be taxed is an overstatement. We rate this claim Mostly False.