English-taught programmes (ETPs) are becoming more prevalent in Europe, according to a new research report just released by the British Council and Studyportals.

The trend represents a significant competitive advantage for European educators at a time when international students are increasingly exploring alternatives to the “Big Four” destinations of Australia, Canada, the UK, and the US. That said, those leading English-speaking destinations still dominate the ETP market.

The report, Mapping English-taught programmes in Europe, shows that as of June 2024, 43% of on-campus ETPs and 58% of online ETPs outside of the Big Four are in Europe.

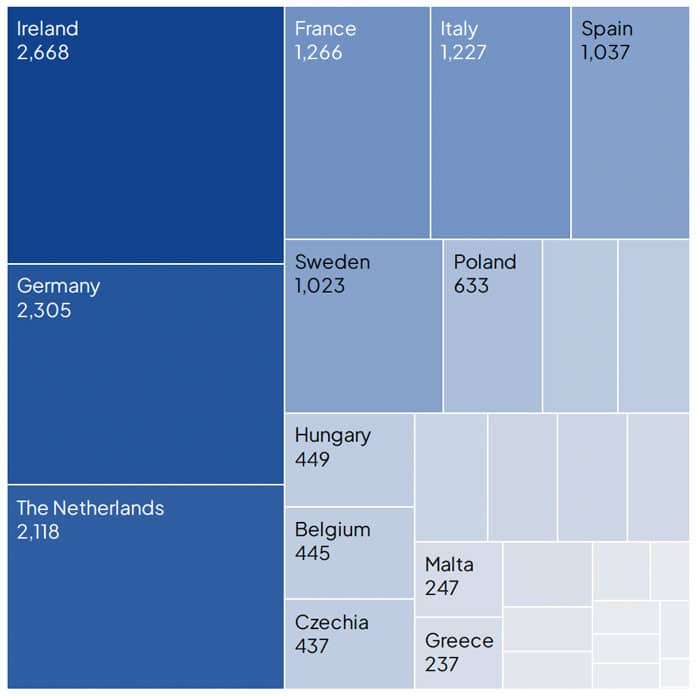

Ireland, Germany, and The Netherlands offer the most

Those three countries each offer more than 2,000 on-campus English-taught degree programmes, followed by France, Italy, and Spain (over 1,000). France and Italy stand out as the EEA countries where growth in ETPs has risen the fastest. France offered roughly 1,200 in 2019 and now offers about 1,400, while Italy’s 960 in 2019 has moved to 1,250.

At the city level, Dublin, Amsterdam, Barcelona, Cork, and Berlin are the top suppliers of ETPs in Europe

Online master’s programmes on the rise

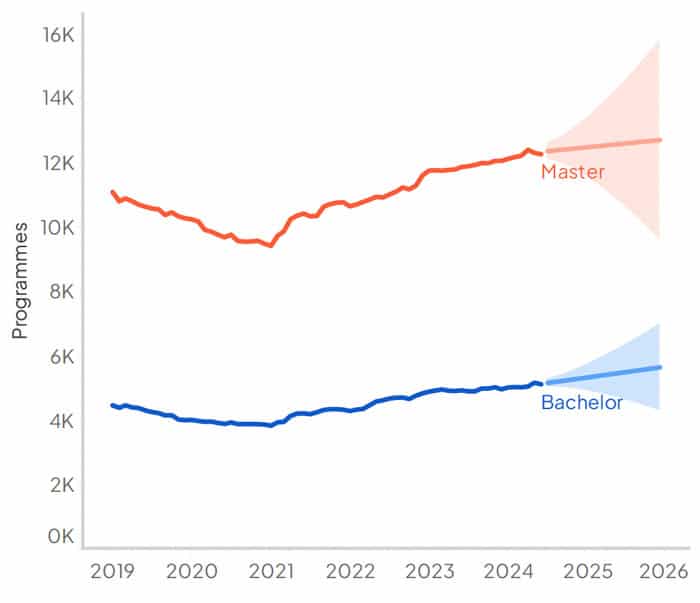

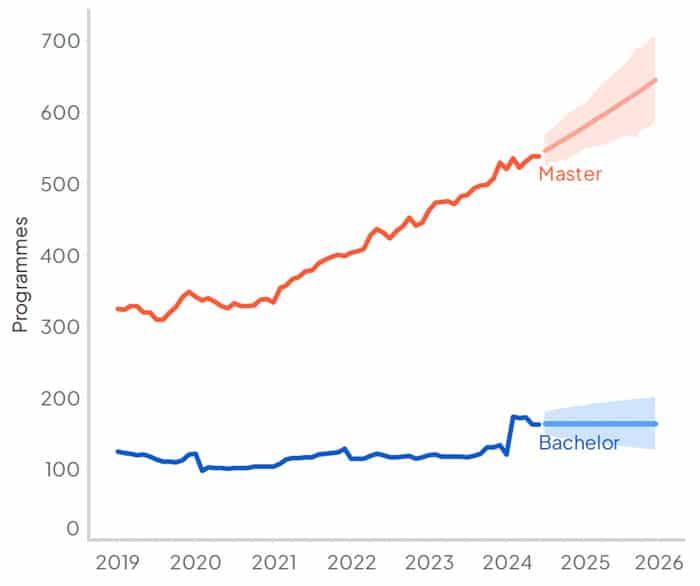

While overall, since 2021, the supply of European-based online degree programmes in English has risen by 67%, the real growth is coming from master’s programmes, as shown below.

The report notes that the online space is one to watch in a context of policy-based limits on international student mobility:

“Several popular study destinations are also implementing policies that restrict international student mobility, with social, economic, and political crises in many source markets further limiting students’ ability to study abroad. Consequently, the digital landscape presents a promising opportunity for EEA institutions to enhance their reputation in both face-to-face and online education.”

German institutions are leading the way in Europe in terms of how quickly they are expanding their supply of online programmes.

“Off the beaten path”

Commenting on the survey results, Piet van Hove, President of EAIE, said:

“In recent years, political trends are severely affecting migration policies as well as putting higher education in a defensive mode. All this adds up to a highly volatile and uncertain landscape for international student mobility. Provision of English-taught programmes is a key indicator of the state of internationalisation, and the EEA is still emerging a strong alternative to the Big Four. More and more, students are looking for truly global education experiences and going off the beaten path.”

Megan Agnew, IELTS Global Partnerships at British Council, noted: “While the Big Four markets … continue to dominate, the shifting landscape of English as a Medium of Education provides international students with more choice than ever before.”

A different approach

Edwin van Rest, cofounder and CEO of Studyportals, commented on the unique lens through which European institutions view internationalisation:

“There is increasing tension between anti-immigration politics in some countries, and a global war for talent and demographic declines. Governments in Europe generally have a strategic approach and see international students are not just a source of tuition revenue and spending power, but are key to addressing talent shortages and increasing national competitiveness.”

For additional background, please see:

Source