Este artículo estará disponible en español en El Tiempo Latino.

Summary

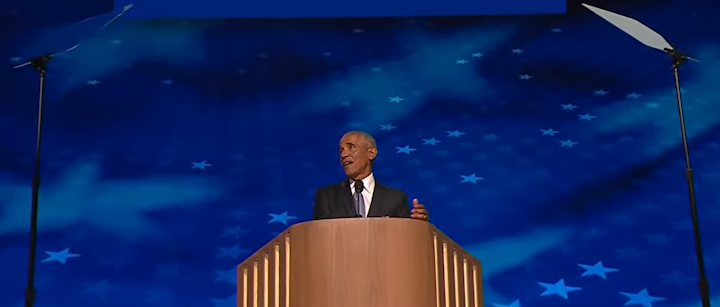

On the second night of the convention, which featured former President Barack Obama and his wife, Michelle, as the headliners, fact-based claims took a back seat to hopeful pronouncements about the future. We still found some political spin:

- Obama claimed that former President Donald Trump “wants the middle class to pay the price for another huge tax cut that would mostly help him and his rich friends.” But most of the tax cuts Trump has proposed would benefit taxpayers at all income levels.

- Barack Obama credited President Joe Biden with delivering “higher wages” for American workers. Wages have gone up since 2020, but not as fast as inflation. The administration argues 2019 is a better comparison due to effects from the pandemic.

- Independent Sen. Bernie Sanders claimed that “Trump’s Project 2025” is “putting forth budgets to cut Social Security, Medicare and Medicaid.” Trump has disavowed the conservative project, which does not call for cutting Social Security.

- Senate Majority Leader Chuck Schumer misleadingly claimed that Donald Trump “issued a Muslim ban as president.” Executive orders that Trump issued in 2017 did not block all Muslims from entering the U.S., as Schumer suggested.

- New Mexico Gov. Michelle Lujan Grisham said that Trump and his running mate, Sen. JD Vance, “want to … repeal the Affordable Care Act and eliminate protections for preexisting conditions.” It’s unclear what Trump would do, since he hasn’t released a plan to replace the ACA. He said he would do so, if “we can come up with something that’s better.”

Analysis

Trump’s Proposed Tax Cuts

Former President Barack Obama claimed that his successor, Donald Trump, “wants the middle class to pay the price for another huge tax cut that would mostly help him and his rich friends.”

At a rally in Pennsylvania on Aug. 19, Trump did promise to “massively cut taxes,” but the tax proposals he has put forth so far would benefit people at all income levels.

“We will have big tax cuts for families and small businesses, and we will have no tax on Social Security and no tax on tips,” Trump said at the rally.

Trump’s proposal to end federal taxes on tips (which Vice President Kamala Harris later said she also supports) is aimed at benefiting mostly low-income workers, though some economists doubt it will work. As for doing away with Social Security taxes, the Tax Policy Center notes that people making less than $32,000 wouldn’t see any benefit because most of their Social Security income already is untaxed.

“In dollar terms, the biggest winners would be those in the top 0.1 percent of income, who make nearly $5 million or more,” Howard Gleckman, a senior fellow at the Tax Policy Center, wrote on Aug. 2. “They’d get an average tax cut of nearly $2,500 in 2025. But as a share of after-tax income, the biggest beneficiaries would be middle- and upper-middle income households, those making between about $63,000 and $200,000.”

But perhaps the most significant of Trump’s tax proposals is his plan to extend the individual tax cuts contained in the Tax Cuts and Jobs Act that Trump championed in 2017. In order to pass the TCJA with a simply majority, Republicans wrote the law to have most of the individual income tax changes expire after 2025. (President Joe Biden has supported only extending the provisions of the TCJA for individual filers earning less than $400,000 and married couples making less than $450,000. Harris has not yet provided a detailed tax plan.)

An analysis of the TCJA by the Tax Foundation estimated that “making the individual provisions of the TCJA permanent would reduce taxes for about 62 percent of filers, leave taxes unchanged for about 29 percent, and increase taxes for just under 9 percent of filers in 2026.”

“The TCJA reduced average tax rates for taxpayers at all income levels because it lowered marginal tax rates, widened tax brackets, doubled the child tax credit and zeroed out personal and dependent exemptions, nearly doubled the standard deduction, and limited several itemized deductions and the alternative minimum tax, among other changes,” according to the March report from Garrett Watson and Erica York of the Tax Foundation.

In 2018, numerous Democrats repeated the talking point that 83% of the tax cuts in the TCJA went to the wealthiest 1%. But as we wrote then, that was only true in the years after most of the individual income tax changes expired.

An analysis by the Tax Policy Center in 2018 found that in the early years, the top 1% of income earners would get 20% to 25% of the tax cut benefits. Only in the law’s later years — after the individual tax cuts expired — TPC noted, would the lion’s share of the tax benefits, 82.8%, accrue to the top 1%. Obama’s claim that Trump’s proposed tax cuts would “mostly help him and his rich friends” doesn’t hold when it comes to the TCJA, because, as we said, Trump has proposed extending all of the individual tax provisions.

In a July 8 blog item, Gleckman wrote that a TPC distributional analysis found if the expiring tax cut provisions in the TCJA were extended, less than half — about 45% — of the tax cut benefits would go to taxpayers earning $450,000 or more. “It also would create winners and losers within income groups,” Gleckman wrote. “For example, TPC found that while about 86 percent of middle-income households would get a tax cut, about 13 percent would see their taxes rise. Among the top 1 percent, taxes would fall for about 81 percent, while they’d rise for 19 percent.”

While not part of his tax plan, Trump’s proposal for tariffs on imported goods would reduce average after-tax incomes of U.S. households, according to a TPC analysis.

Wages Under Biden

In his tribute to the man he selected as vice president in 2008, Obama praised Biden for his leadership navigating troubled economic waters during the pandemic. In ticking off Biden’s accomplishments as president, Obama said Biden delivered “higher wages” for American workers.

It is true that wages for rank-and-file workers went up significantly under Biden. Average weekly earnings for production and nonsupervisory workers — who make up 81.4% of all private sector workers — went up 17.3% during Biden’s first 42 full months in office, according to the Bureau of Labor Statistics.

However, those gains were erased by higher inflation during Biden’s time in office.

In July, “real” weekly earnings, which are adjusted for inflation and measured in dollars valued at their average level in 1982-84, were still 2.2% below where they were when Biden took office in January 2021.

The Biden administration has argued that the pandemic’s impact on the economy distorted real wage data.

In an April 2021 report, the White House Council of Economic Advisers wrote that early in the pandemic “millions of relatively low-paid workers lost their jobs, while relatively high-paid workers remained employed,” resulting in a “sharp, one-month increase in reported average wages.” For that reason, the Biden administration, including Treasury Secretary Janet Yellen, prefers to compare real wage growth with pre-pandemic levels in 2019 before Biden took office.

As we have written, Yellen said in June that “wages have gone up somewhat more than prices” for all Americans. Her office cited two reports, including a January Treasury report that said “the typical middle-class worker has seen their real weekly earnings rise 2.4 percent since 2019.”

Social Security and Medicare

While talking about what are “radical” plans, Sen. Bernie Sanders, an independent, mentioned Project 2025, a conservative plan to overhaul the federal government.

“Let me tell you what a radical agenda is, and that is Trump’s Project 2025,” said Sanders, who went on to say, “putting forth budgets to cut Social Security, Medicare and Medicaid is radical.”

First, it is not “Trump’s Project 2025,” as the former president has disavowed the proposal, calling it “seriously extreme.” However, CNN has reported that more than 100 people involved in the project worked in the Trump administration.

And while the 900-plus page document does propose making changes to the Medicare and Medicaid programs, it says nothing about cutting Social Security. The project’s authors have said the claim that it cuts Social Security is “false.”

“Mandate for Leadership,” the title of the document, “does not advocate cutting Social Security,” the authors wrote in a July 9 X post.

Furthermore, as we’ve written before, Trump has said that he would not cut Social Security and Medicare benefits if elected.

In addition, when he was president, his budget proposals did not call for any cuts to Social Security’s retirement benefits. His budgets did include plans to cut Social Security Disability Insurance and Supplemental Security Income programs, which would have reduced benefits for some participants.

As for Medicare, Trump’s budgets proposed to reduce the growth of Medicare without cutting benefits. The proposals included bipartisan ideas also supported by Obama, experts told us in 2020.

Trump Didn’t Ban All Muslims

Sen. Chuck Schumer, the Senate majority leader, misleadingly claimed that Trump “issued a Muslim ban as president.”

Trump did call for a “total and complete shutdown of Muslims entering the United States” in December 2015, during his first presidential campaign. In a statement, he said the shutdown needed to happen “until our country’s representatives can figure out what is going on” with polls showing a “great hatred towards Americans by large segments of the Muslim population.”

However, once he became president, Trump’s executive actions did not go as far as what he originally proposed, as we’ve written before.

In January 2017, Trump issued an executive order — Protecting the Nation from Foreign Terrorist Entry into the United States — that temporarily paused U.S. admissions of nationals from Iraq, Syria, Iran, Libya, Somalia, Sudan and Yemen. The order ended up being blocked by a federal judge, but the Pew Research Center estimated that it would have affected only about 12% of Muslims in the world.

A second executive order issued by Trump, which removed Iraq from the list of countries on the travel ban, was also halted by courts. On his third attempt, Trump issued a proclamation that restricted certain nationals of Iran, Libya, Somalia, Syria, Yemen, North Korea and Venezuela from obtaining visas to travel to the U.S. The Supreme Court ruled that the proclamation could stand.

But even though five of those seven countries are majority Muslim nations, the proclamation still did not ban all Muslims from coming to the U.S., as Schumer’s claim suggested.

ACA and Preexisting Conditions

New Mexico Gov. Michelle Lujan Grisham claimed that Trump and his running mate, Sen. JD Vance, “want to … repeal the Affordable Care Act and eliminate protections for preexisting conditions.” Trump hasn’t proposed a health care plan, but he has continued to talk about replacing the ACA with something “better.” In the past, he has supported plans that would weaken, but not completely “eliminate,” the ACA’s protections for those with preexisting health conditions.

When he was president, Trump tried, and failed, to end or replace the ACA — even when Republicans controlled both houses of Congress. His administration supported a lawsuit that would have nullified the entire law. The Supreme Court ultimately ruled that the plaintiffs didn’t have standing to bring the suit.

But Trump is still talking about doing something about the health care law — maybe.

Trump posted on social media in November that Republicans “should never give up” on terminating the ACA. In late March, he said he wanted to make the ACA “better” and cheaper, but didn’t offer any details. Several top Republicans have said his call to not give up on ending the ACA is a non-starter in Congress.

More recently, in an Aug. 15 rally in North Carolina, Trump said the ACA “stinks,” but he would “keep it unless we can come up with something that’s better for you and less expensive for you, otherwise we’re not doing it.”

Vance, in an interview published Aug. 1 on the news site NOTUS, also indicated that a Trump/Vance administration would do something “to fix the health care problem in this country.” He said, “I think you’re certainly gonna see efforts to reform the system. Obviously, what that looks like will depend a little bit on Congress because Congress has to have a role to play.”

As we’ve explained before, ending the ACA would reduce the protections for people with preexisting conditions considerably. The ACA prohibits insurers from denying coverage or charging people more based on their health status. The law also bars insurers from refusing to cover a certain condition, and it requires plans to cover 10 essential benefits.

As of 2022, 20 million people, or about 6.3% of the U.S. population, got coverage on the individual market, where these protections are a significant change from the pre-ACA insurance market. Before the ACA, employer plans still had some preexisting condition protections: They couldn’t deny a policy to an employee. But if a new employee had a lapse in insurance coverage, employer plans could decline coverage for some preexisting conditions for a limited period.

Given the lack of a health care plan from Trump, we can’t say how he might change the ACA. He has expressed support for protecting those with preexisting conditions, but his record shows he hasn’t supported keeping all of the law’s provisions.

Trump supported a 2017 GOP bill that would have included only some of the ACA’s protections. He also pushed the expansion of cheaper short-term health plans that wouldn’t have to abide by the ACA’s prohibitions against denying or pricing coverage based on health status.

Editor’s note: FactCheck.org does not accept advertising. We rely on grants and individual donations from people like you. Please consider a donation. Credit card donations may be made through our “Donate” page. If you prefer to give by check, send to: FactCheck.org, Annenberg Public Policy Center, 202 S. 36th St., Philadelphia, PA 19104.

Sources

Bureau of Labor Statistics. “Employment, Hours and Earnings from the Current Employment Statistics survey (National); Average Weekly Earnings of Production and Nonsupervisory Employees, total private.” Accessed 21 Aug 2024.

Bureau of Labor Statistics. “Employment, Hours and Earnings from the Current Employment Statistics survey (National); Average Weekly Earnings of Production and Nonsupervisory Employees, 1982-1984 dollars, total private.” Accessed 21 Aug 2024.

U.S. Bureau of Labor Statistics. “Employment, Hours, and Earnings from the Current Employment Statistics survey (National): Total Nonfarm.” Accessed 21 Aug 2024.

Bureau of Labor Statistics. “Employment, Hours, and Earnings from the Current Employment Statistics survey (National); Production and nonsupervisory employees, thousands, total private, seasonally adjusted.” Accessed 21 Aug 2024.

Rouse, Cecilia and Martha Gimbel. “The Pandemic’s Effect on Measured Wage Growth.” Council of Economic Advisers. 19 April 2021.

Cohen, Ben. “Competing Narratives on Real Wages, Incomes Under Biden.” FactCheck.org. 26 Jun 2024.

“‘This Week’ Transcript 6-16-24: Secretary of the Treasury Janet Yellen, Sen. Tim Scott and Bob Woodward & Carl Bernstein.” ABC News. 16 Jun 2024.

Van Nostrand, Eric et al. “An Update to ‘The Purchasing Power of American Households.’” U.S. Department of Treasury. 25 Jan 2024.

Gorman, Reese. “JD Vance Is Filling In Trump’s Policy Gaps.” NOTUS. 1 Aug 2024.

Bolton, Alexander. “Senate GOP won’t ‘walk the plank’ for Trump on ACA repeal.” The Hill. 18 Mar 2024.

Trump, Donald (@realDonaldTrump). ACA statement. Truth Social. 26 Mar 2024.

Colvin, Jill and Zeke Miller. “Trump says he will renew efforts to replace ‘Obamacare’ if he wins a second term.” Associated Press. 27 Nov 2023.

Keith, Katie. “Trump Administration Asks Court To Strike Down Entire ACA.” Health Affairs. 26 Mar 2019.

Trump, Donald. FULL SPEECH: Trump rally in Asheville, NC. FOX 5 Washington DC. YouTube.com. 14 Aug. 2024.

U.S. Department of Health and Human Services. “Can I get coverage if I have a pre-existing condition?” 20 Apr 2023.

KFF. Health Insurance Coverage of the Total Population. accessed 21 Aug 2024.

Essential health benefits. HealthCare.gov. accessed 21 Aug 2024.

Trump, Donald. Executive Order on An America-First Healthcare Plan. 24 Sep 2020.

Robertson, Lori. “Bloomberg, Trump Spar on Preexisting Conditions.” FactCheck.org 14 Jan 2020.

Robertson, Lori. “Trump on Health Insurance Costs.” FactCheck.org. 27 Feb 2018.

Robertson, Lori. “Biden Misleads on Preexisting Conditions.” FactCheck.org. 1 Sep 2020.

Trump, Donald. “Donald J. Trump Statement on Preventing Muslim Immigration.” Press release. 7 Dec 2015.

Gore, D’Angelo and Lori Robertson. “Trump’s ‘Travel Ban’ Doesn’t Affect All Muslims.” 28 Jun 2018.

Desilver, Drew and David Masci. “World’s Muslim population more widespread than you might think.” Pew Research Center. 31 Jan 2017.

Trump, Donald. “Executive Order Protecting The Nation From Foreign Terrorist Entry Into The United States.” White House. 6 Mar 2017.

Trump, Donald. “Presidential Proclamation Enhancing Vetting Capabilities and Processes for Detecting Attempted Entry Into the United States by Terrorists or Other Public-Safety Threats.” White House. 24 Sep 2017.

Trump, Donald. “Executive Order Protecting the Nation from Foreign Terrorist Entry into the United States.” White House. 27 Jan 2017.

Robertson, Lori. “Competing Claims on Trump’s Budget and Seniors.” FactCheck.org. 18 Feb 2020.

Project 2025, Presidential Transition Project. “Mandate for Leadership: The Conservative Promise.” Accessed 20 Aug 2024.

Farley, Robert. “Trump’s Comments About ‘Cutting’ Entitlements in Context.” FactCheck.org. 15 Mar 2024.

Dore, Kate. “Trump and Harris both want no taxes on tips. Here’s why policy experts don’t like the idea.” CNBC. 13 Aug 2024.

Durbin, Dee-Ann. “Why Trump’s and Harris’ proposals to end federal taxes on tips would be difficult to enact.” AP. 13 Aug 2024.

Gleckman, Howard. “Trump’s Social Security Benefit Tax Repeal Would Lower Taxes, Accelerate Program Insolvency.” Tax Policy Center. 2 Aug 2024.

Robertson, Lori. “Democrats’ Misleading Tax Line.” FactCheck.org. 16 Jan 2018.

White House website. Budget of the U.S. Government, Fiscal Year 2025.

Trump-Vance campaign website. Press release: “Only President Trump Can Bring Our Economy Back On Track.” 19 Aug 2024.

Watson, Garrett and York, Erica. “Tax Calculator: How the TCJA’s Expiration Will Affect You.” Tax Foundation. 12 Mar 2024.

Tax Policy Center. Distributional Analysis of the Conference Agreement for the Tax Cuts and Jobs Act. 18 Dec 2017.

Tax Policy Center. “T24-0050 – Enact 60 Percent Tariff on Imports from China and 10 Percent Tariff on Imports from All Other Countries by ECI Percentile, 2025.” 15 Aug 2024.