By Asuquo Cletus

The Cross River State Government has announced plans to ramp up its Internally Generated Revenue (IGR) to ₦10 billion monthly, leveraging on new national tax reforms, expanded automation systems, as well as increased compliance from high-net-worth individuals and previously untaxed sectors.

The revenue drive is part of the state’s broader economic recovery and self-reliance agenda, aimed at reducing over-dependence on federal allocations and funding critical infrastructure and social services.

The government says the strategy will be implemented through policy reforms, digital tracking systems, and enhanced enforcement mechanisms across ministries and revenue-generating agencies.

READ ALSO: NDDC Commissioner Orok Duke Celebrates Family Member’s Academic Achievement in UK

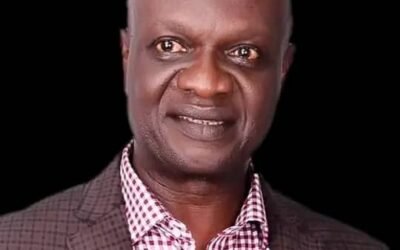

This was disclosed by the Executive Chairman of the Cross River Internal Revenue Service (CRIRS), Edwin Okon, during a two-day strategic workshop held in Calabar, themed: “Leveraging on the Gains of the New National Reform Acts for Improved Revenue Growth and Economic Development in Cross River State.”

Okon explained that the workshop served as a half-year performance review and planning session to assess the state’s revenue performance in the first six months of the year and retool its plans ahead of the January 2026 implementation of recently signed national tax reform acts.

“Our revenue currently stands at about ₦4 billion monthly. But with the machinery we’ve put in place and the gains from the new tax reforms, we are confident of meeting a ₦10 billion monthly target,” Okon stated.

He clarified that the state would not increase the burden on poor citizens but would instead expand the tax base to include more income streams, wealth holders, and property owners, many of whom have traditionally operated outside the tax net.

“The president’s directive and Governors is clear we are not taxing poverty. We are going after wealth, income sources, and exemptions that were previously left out. This ensures fairness and sustainable growth,” he added.

Okon revealed that automation of revenue collection has significantly improved transparency and plugged leakages in several government agencies.

He cited a sharp increase in revenue from the Forestry Commission from less than ₦10 million to over ₦35 million in six months alongside new digital payment systems now operational in state-owned schools, hospitals, and the judiciary.

“Automation is helping us ensure government funds go where they should. More importantly, it eliminates human interference and boosts public confidence in our system,” he said.

The Executive Chairman further commended Governor Bassey Otu for providing consistent political support to revenue efforts, stating that the governor has never interfered in the agency’s enforcement work.

“The governor has never called to stop us from collecting taxes from anyone. That alone speaks volumes about his commitment to reform,” he said.

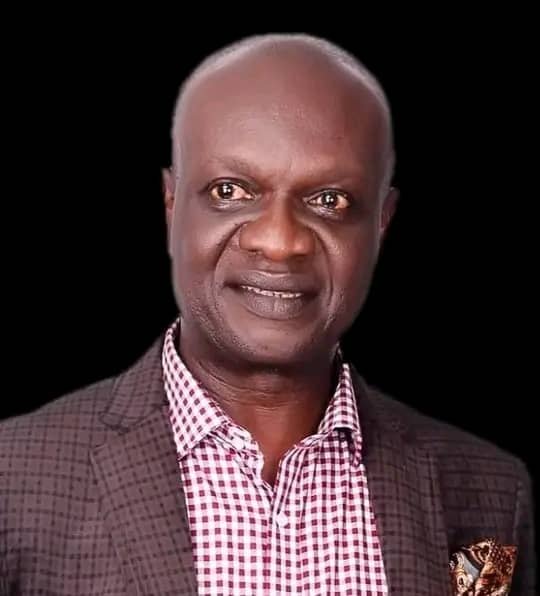

On his part, the Commissioner for Finance, Michael Odere, decried the inefficiencies and abuse within critical sectors, particularly the unregulated proliferation of private boreholes, which he said have undermined public utilities and drained government resources.

“Let me say clearly the honeymoon is over. There will be consequences for those who bypass due process. We must all begin to do things right. The regulatory agencies will act,” he warned.

Odere emphasized that the government is shifting focus from initiating new capital projects to reviving existing public infrastructure, such as the state library, hospitals, and public water supply—especially for the benefit of vulnerable citizens.

“The governor is prioritizing the needs of the common man clean water, security, basic services. These are not luxuries. They are rights,” he stated.

Representing the Head of Service, Innocent Eteng, Dr. Obeten Obeten called on public servants to uphold professionalism and accountability as critical drivers of public policy success.

“No reform can work without the full cooperation of civil servants. We must become champions of accountability and efficient service delivery,” Obeten said.

Also speaking at the workshop, Essien Ukoroebi, a chartered accountant and public finance expert, urged the state to double down on its digital revenue strategy while investing in public sensitization to promote voluntary tax compliance.

“We can’t keep operating a cash-and-paper economy. Technology must be central to our fiscal plan. But beyond systems, we need to shift public attitudes. Paying tax is a civic duty, not a punishment,” Ukoroebi said.

He added that more awareness campaigns should target the informal sector, high-value property owners, and professionals who underreport or evade taxes.

The high-level workshop drew participation from top government officials, including the Commissioner for Lands, economic advisers, directors of key MDAs, and private-sector stakeholders. Discussions focused on aligning state tax policy with national reforms, enhancing inter-agency coordination, and plugging revenue leakages.

The workshop ended with strong commitments from all stakeholders to implement reform-driven strategies, increase transparency, and ensure that every revenue stream is harnessed to improve governance, economic resilience, and public service delivery in Cross River State.