By Kelvin Obambon

The Cross River Internal Revenue Service (CRIRS) has held a road walk to drive extensive tax compliance awareness campaign across streets and markets in 8Miles, aimed at educating citizens on the importance of tax payment for community and state development.

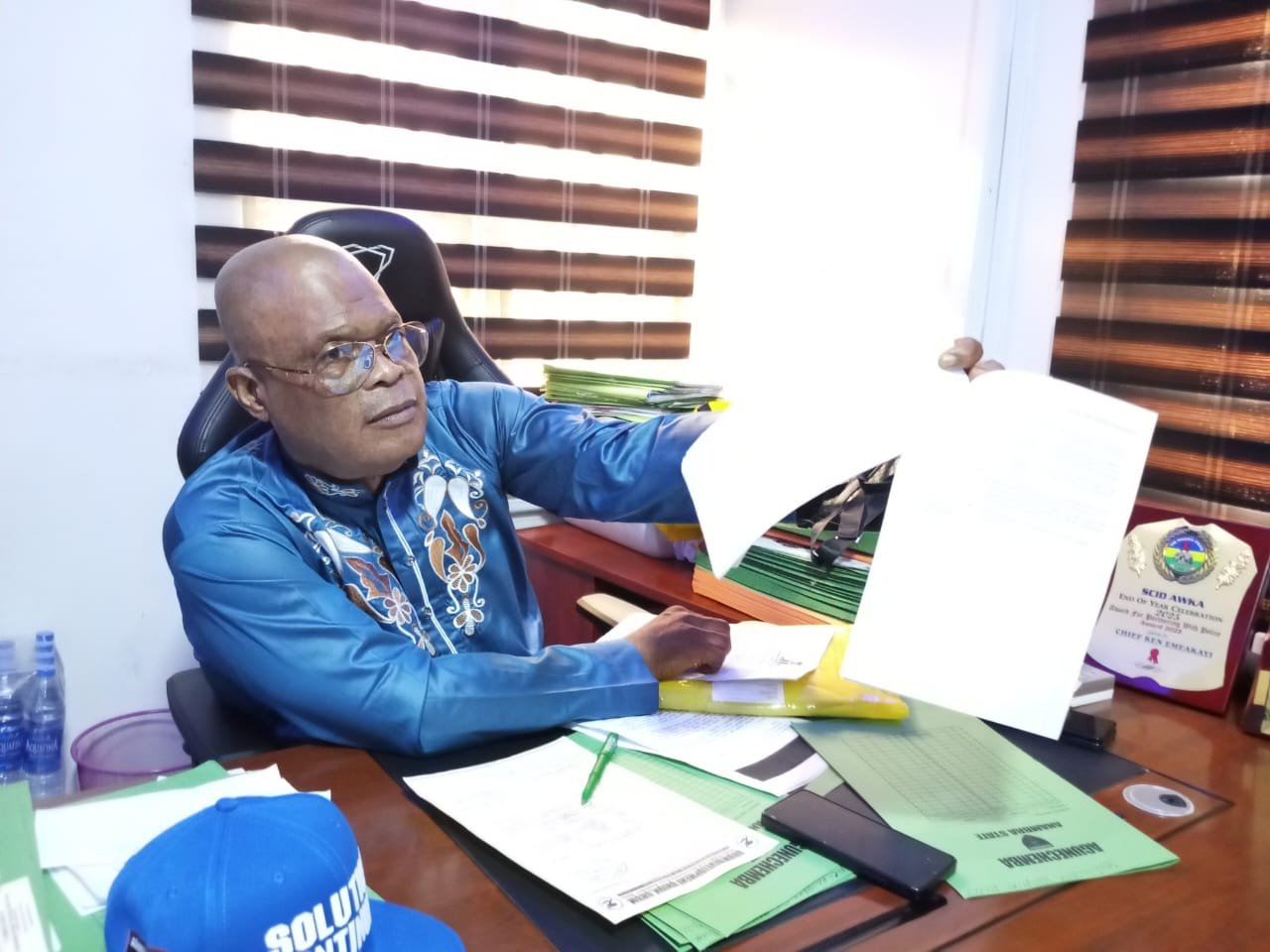

Speaking with journalists during the event at Ikpai Omin – 8Miles, Calabar, on Thursday, Prince Edwin Okon, Executive Chairman of CRIRS, emphasized the campaign’s role in reminding residents about their tax obligations.

“It’s not just a walk, but an awareness campaign,” Okon said, highlighting that taxes and levies are crucial sources of revenue used by the government to fund vital projects.

READ ALSO: Orok Duke: Media Team Celebrates NDDC Commissioner on His Birthday

He praised the state government’s developmental strides, pointing to recent approvals by the Executive Council for projects in various communities, including road constructions and hospital renovations in areas previously underserved. He stressed that such initiatives depend on the financial contributions of the citizens through taxes.

Announcing that a local tax office now operates at 147 Ikpai Omin, beside Poly Clinic, 8Miles, the CRIRS Chairman urged taxpayers to use the facility for inquiries and payments instead of travelling to the headquarters.

He also reassured the public that creating a Tax Identification Number (TIN) is free and encouraged residents to obtain their TINs, which according to him, will soon serve as essential identification for accessing hospitals and other vital services.

Okon however advised residents not to “Give cash to anybody,” but should “Make payments directly into government accounts,” as this will ensure transparency and accountability in revenue collection.

He concluded by appealing for increased tax compliance to sustain ongoing development and enable the government to deliver regular progress reports to the people.

Traders at the mini market by walk over and the main market at 8Miles were sensitized and flyers distributed to residents and shop owners along the routes.

The campaign marks a proactive move by the Internal Revenue Service to bridge the information gap and enhance tax collection crucial for the state’s sustained growth.