On 2 January 2024, when Canadian Immigration Minister Mark Miller announced a two-year cap on new study permits, he explained that:

“For 2024, the cap is expected to result in approximately 364,000 approved study permits, a decrease of 35% from [the number of study permits issued in] 2023.”

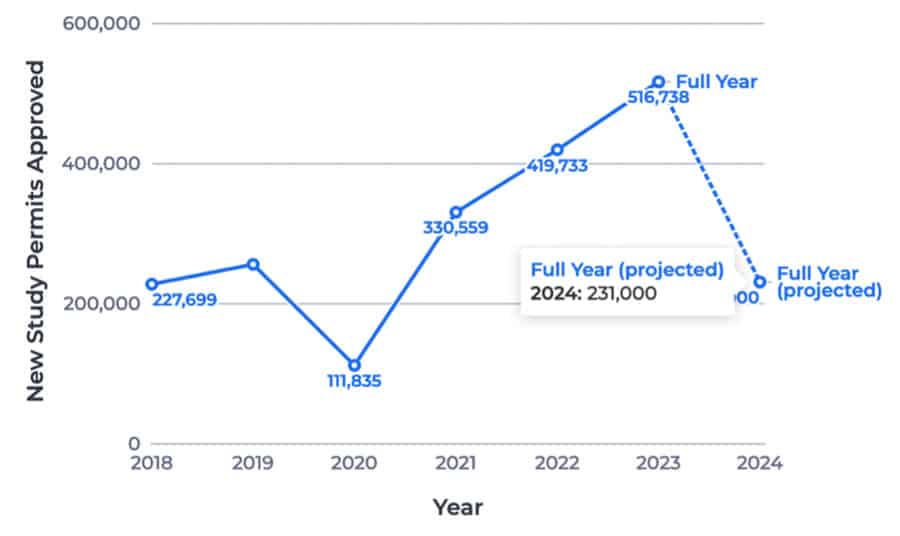

Whatever math was behind his projection, it now seems very flawed. An ApplyBoard analysis finds that if current study permit processing and approval rates remain at their January–June 2024 levels, 47% fewer study permits will be awarded in 2024 than in 2023. The global recruitment platform visualises this projected decline in the following graph, which anticipates approvals falling to levels not seen since 2018.

ApplyBoard summarises the logic of its analysis like this:

- “The number of new study permit applications processed by the Canadian government dropped by 54% in Q2 2024 versus Q2 2023. Year over year, we project the number of applications processed to drop by 39% in 2024.

- If current trends hold, around 230,000 new study permits will be processed in the second half of 2024.

- If the study permit processing projection above is accurate, and the study permit approval rate stays at 51%, we estimate that just over 231,000 new study permits will be approved in 2024. This projected approval count is roughly 47% lower than the 436,600 new study permits which were approved in 2023.”

Those mid-year totals demonstrate that student demand is shifting away from Canada under the new policy settings due to the confusion and uncertainty arising from the new rules this year. ApplyBoard found that even Canadian post-secondary programmes that are not included in the cap are experiencing lower demand:

“In Q1 2024, applications decreased by 26% year-over-year for programs affected by the study permit caps. Cap-exempt programs (master’s and doctoral degree programs) also saw a [year-over-year] dip of 21%.”

ApplyBoard’s projection for full-year 2024 are a 50% and 24% reduction in study permits for capped post-secondary programmes (e.g., undergraduate programmes) and cap-exempt programmes, respectively.

Approval rates dropping this year

The number of new study permits granted in any year depends on the number of applications students submit, how fast the Canadian government processes them, and the approval rate.

Looking only at one quarter of the year, Q2, ApplyBoard found a 54% year-over-year drop in the number of applications processed, rising to a 70% decline in Ontario, the Canadian province hosting by far the most international students in the country.

What’s more, between January-June 2024, 48% fewer study permit applications were approved. In fact, the approval rate fell to 51% in the first two quarters of 2024, compared with 58% in 2023. This is important because the math the government performed to arrive at its two-year “zero growth” cap on new study permits included an assumption that the approval rate would be 60% in 2024. ApplyBoard explains further that:

“While it’s possible the approval rate may improve in July–December 2024, to max out the full number of possible study permits, demand would have to rise as well. With an estimated 230,000 study permits projected to be processed in the last half of the year, even an approval rate of 100% would not be enough, given that only 114,000 study permits were approved in the first six months of 2024.”

Students from top sending markets looking elsewhere

Between January and June 2024, only half as many Indian students were approved for study permits as in the same period in 2023 despite a relatively high approval rate of 85% for this market. Even more extreme: a 76% reduction in approved study permits for Nepali students, a more than 70% reduction for Nigerian students, and a 65% decline for Filipino students.

Many prospective students from key markets like these are aware of:

- A new savings requirement of more than CDN$20,000 to be eligible for a study permit;

- The removal of the right for partners of undergraduate students to receive an open work visa;

- The elimination of post-study work eligibility for students enrolled in college programmes delivered via private-public partnerships;

- Rumours of further immigration rulings down the line that would affect international students.

ApplyBoard notes that the overall “drop in permits processed [in the first half of 2024] can be attributed both to students who paused or deferred their study permit application and to others who pivoted to different destinations.”

The US, Germany, Italy, and other destinations are picking up share from Canada (as well as Australia and the UK) according to Studyportals research. For its part, ApplyBoard has detected a 20% decline in global searches for “study in Canada” this year compared to 2023.

Institutions under pressure

Gabriel Miller, president of Universities Canada, is predicting a 45% decline in international enrolments for higher education institutions in Canada this fall. Speaking recently to the Globe & Mail, he explained: “This is a hit, a national hit to university budgets that we haven’t seen in modern memory…The most important piece of feedback we’ve heard is just real uncertainty and confusion about what kind of opportunities there are going to be to come and study in Canada, and what the rules would be.”

Meanwhile, Michael McDonald, director of government relations at Colleges and Institutes Canada, expects enrolments to be down by more than 35% for his association’s members.

Todd Mondor, president of the University of Winnipeg, said separately to the Globe and Mail that international enrolment declines have wiped out CDN$4.5 million from his university’s budget. He said: “We’ll do everything we can to preserve student support services and make sure students succeed here, but there will be impacts…we’re just keeping our fingers crossed they can be minimised.”

Larissa Bezo, president of the Canadian Bureau for International Education, also spoke with the Globe and concluded:

“The perception of us having closed the doors to international students has resulted in very significant damage to our sector. What we have to appreciate is the recovery time. When you have that kind of reputational damage, given enrolment cycles, etc, you’re looking at a five to seven-year time horizon.”

For additional background. Please see:

Source