Summary

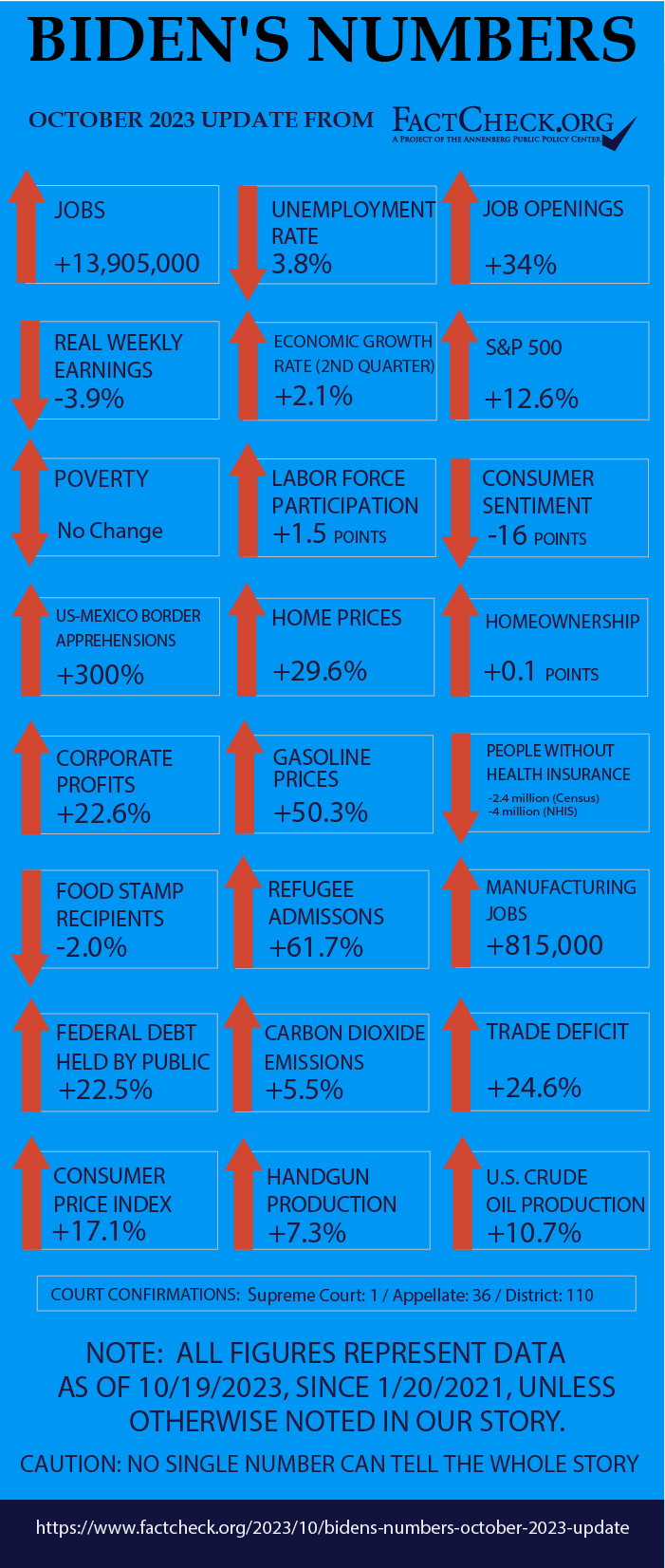

Since President Joe Biden took office:

- The economy added 13.9 million jobs, putting the total 4.5 million higher than before the pandemic.

- The unemployment rate dropped for a time to the lowest in nearly 54 years; unfilled job openings surged, with 3 jobs for every 2 unemployed job seekers.

- Inflation surged to the highest level in over 40 years. Despite slowing their rise lately, consumer prices are up nearly 17.1% overall. Gasoline is up 50.3%.

- Average weekly earnings haven’t kept pace with prices. After adjusting for inflation, “real” weekly earnings dropped 3.9%.

- The U.S. murder rate declined by one-half of a point.

- Defying economists who have been predicting a recession for more than a year, the economy expanded at an annual rate of 2.2% in the first quarter and 2.1% in the second quarter.

- After-tax corporate profits increased in the second quarter of this year — the first increase in a year.

- Inflation-adjusted median household income went down by 2.7%. The official poverty rate is the same as the year before he took office.

- Those lacking health insurance went down — by 0.7 percentage points by one measure and 1.3 points by another.

- U.S. crude oil production is up 10.7%; imports are up 7.4%.

- Homeownership rates have barely budged under Biden.

- The U.S. accepted 60,014 refugees in fiscal year 2023 — the highest amount in seven years, but less than half of Biden’s campaign goal of admitting up to 125,000.

- The number of apprehensions of those trying to cross the southern border illegally crept back up in recent months, and is up 300% overall.

- Debt held by the public has increased by 22.5%.

- The trade deficit for goods and services has gone up by 24.6%.

Analysis

This is our eighth installment of “Biden’s Numbers,” a quarterly feature we launched in January 2022. As we also did for former Presidents Barack Obama and Donald Trump, we provide the latest statistics on a range of topics from authoritative sources on what has happened in the country since the president was inaugurated.

Opinions will vary on whether a president deserves credit or blame for these figures, and we take no position on that.

Jobs and Unemployment

The number of people with jobs has increased dramatically since Biden took office, surpassing pre-pandemic levels by more than 4.5 million.

Employment — The U.S. economy added 13,905,000 jobs between Biden’s inauguration and September, the latest month for which data are available from the Bureau of Labor Statistics. The September figure is 4,503,000 higher than the February 2020 peak of employment before COVID-19 forced massive shutdowns and layoffs.

Some categories are still lagging, however. There were 89,000 fewer public school teachers and other local government education workers in September than there were at the pre-pandemic peak, and 187,500 fewer hotel and restaurant workers and others in the accommodation and food services industries.

Unemployment — The unemployment rate fell from 6.3% at the time Biden took office to 3.4% in January and again in April, the lowest since June 1969. Most recently the rate has crept up to 3.8% in September, or 0.3 points above the pre-pandemic rate.

Job Openings — The number of unfilled job openings soared, reaching a record of over 12 million in March of last year, but then declined after the Federal Reserve began a steep series of interest rate increases aimed at cooling the economy to bring down price inflation.

The number of unfilled jobs was 9.6 million as of the last business day of August, the most recent month on record. That’s still an increase of over 2.4 million openings — or 34% — during Biden’s time.

In August, there was an average 3 jobs for every 2 unemployed job seekers. When Biden took office, there were more unemployed job seekers than job openings.

The number of job openings in September is set to be released Nov. 1

Labor Force Participation — One reason many job openings go unfilled is that millions of Americans left the workforce during the pandemic and haven’t returned. The labor force participation rate (the percentage of the total population over age 16 that is either employed or actively seeking work) has risen slowly during Biden’s time, from 61.3% in January 2021 to 62.8% in September.

That still leaves the rate well short of the pre-pandemic level of 63.3% for February 2020.

The rate peaked at 67.3% more than two decades ago, during the first four months of 2000. Labor Department economists project that the rate will trend down to 60.1% in 2031, “primarily because of an aging population.”

Manufacturing Jobs — During the presidential campaign, Biden promised he had a plan to create a million new manufacturing jobs — and whether it’s his doing or not, the number is getting close to that target.

As of September, the U.S. added 815,000 manufacturing jobs during Biden’s time, a 6.7% increase in the space of 32 months, according to BLS. Furthermore, the September total is 226,000 (or 1.8%) above the number of manufacturing jobs in February 2020, before the pandemic forced plant closures and layoffs.

During Trump’s four years, the economy lost 170,000 manufacturing jobs, or 1.4%, largely due to the pandemic.

Wages and Inflation

CPI — Inflation came roaring back under Biden. During his first 32 months in office, the Consumer Price Index rose 17.1%.

It was for a time the worst inflation in decades. The 12 months ending in June 2022 saw a 9.1% increase in the CPI (before seasonal adjustment), which the Bureau of Labor Statistics said was the biggest such increase since the 12 months ending in November 1981.

Inflation has moderated since then. The CPI rose 3.7% in the 12 months ending in September, the most recent figure available.

Gasoline Prices — The price of gasoline shot up even faster.

During the week ending Oct. 16, the national average price of regular gasoline at the pump was $3.58. That’s $1.20 higher than in the week before Biden took office, an increase of 50.3%.

The price swung even more wildly during Biden’s first year and a half, hitting just over $5 per gallon in the week ending June 13, 2022. That’s the highest on record. The rise was propelled by motorists resuming travel after pandemic lockdowns and then by Russia’s invasion of Ukraine on Feb. 24, 2022.

Wages — Wages also have gone up under Biden, but not as fast as prices.

Average weekly earnings for rank-and-file workers went up 13.1% during Biden’s first 32 months in office, according to monthly figures compiled by the BLS. Those production and nonsupervisory workers make up 81% of all employees in the private sector.

But inflation ate up all that gain and more. “Real” weekly earnings, which are adjusted for inflation and measured in dollars valued at their average level in 1982-84, actually declined 3.9% since Biden took office.

More recently, real wages have been inching up, rising 0.7% since hitting the low point under Biden in June 2022.

Crime

Both the number and rate of violent crimes, including murders specifically, have gone down under Biden, from 2020 to 2022, according to the FBI’s annual reports on nationwide crime.

The FBI released its latest “Crime in the Nation” data, covering 2022, on Oct. 16. Its estimates show a drop in the murder and nonnegligent manslaughter rate of 0.5 points, from 6.8 per 100,000 population in 2020 to 6.3 in 2022. The number of murders declined by 5.6%, totaling an estimated 21,156 last year.

The violent crime rate dropped by 15.4 points, to 369.8 per 100,000 population in 2022. (For these figures, see Table 1 in the CIUS Estimations download for the crime in the U.S. reports.)

The FBI’s 2022 report is based on figures voluntarily provided by 15,724 law enforcement agencies, which represent 93.5% of the U.S. population. Last year, the FBI had an issue with a lower participation rate, because it had switched to a new crime reporting system in 2021 that many law enforcement agencies, including those in New York City and Los Angeles, hadn’t yet adopted. That made it difficult for the FBI make nationwide comparisons to prior years. But for 2022, the FBI permitted agencies that hadn’t yet transitioned to the new system to submit data in another manner. As a result, all U.S. cities with 1 million population or more provided statistics for the full year, the FBI said.

The property crime rate also declined a bit, by 9.5 points, from 2020 to 2022. But there was a notable increase in motor vehicle thefts: The rate increased by 35.2 points to 282.7 vehicle thefts per 100,000 people.

The decrease in murder and aggravated assaults under Biden, however, hasn’t yet brought those figures back to their 2019 levels, before an increase in both offenses during the 2020 pandemic. For instance, the 6.3 murder rate for 2022 is still higher than the 5.2 rate for 2019.

!function(e,n,i,s){var d=”InfogramEmbeds”;var o=e.getElementsByTagName(n)[0];if(window[d]&&window[d].initialized)window[d].process&&window[d].process();else if(!e.getElementById(i)){var r=e.createElement(n);r.async=1,r.id=i,r.src=s,o.parentNode.insertBefore(r,o)}}(document,”script”,”infogram-async”,”

Statistics from other sources reflect the same trend over the past few years, and show murders have continued to decline in 2023.

The latest figures from the Major Cities Chiefs Association show a 10.9% decline in the number of murders for the first half of 2023, compared with the same time period in 2022, in 69 large U.S. cities.

There was also a drop in murders in large cities in 2022. These decreases come after a 33.4% increase in the number of murders in large cities from 2019 to 2020, according to the Major Cities Chiefs Association, and a smaller 6.2% rise from 2020 to 2021, Biden’s first year in office.

The nonpartisan think tank Council on Criminal Justice published a midyear report on 30 U.S. cities that similarly found decreases in several crimes, including homicides, for the first half of 2023, compared with the same time period last year. But it found a large increase in motor vehicle thefts: 33.5%.

CCJ noted that despite the recent declines in homicides, the number for the first half of this year remained higher than the first half of 2019, “the year prior to the COVID pandemic and racial justice protests of 2020.”

“The authors conclude that crime patterns continue to shift as the nation has emerged from the COVID pandemic and that policymakers and communities must act urgently to adapt their strategies to meet the new challenges,” CCJ said in a summary of its report. “Though the level of serious violent crime is far below historical peaks, it remains intolerably high, especially in poorer communities of color.”

Economic Growth

Economic growth has been stronger than expected, defying economists who have been predicting a recession for more than a year.

The real gross domestic product, which accounts for inflation, increased 5.8% in 2021 and slowed to 1.9% in 2022, when some economists predicted that the country was headed for a recession.

But the growth has continued in 2023 — albeit at a relatively slow rate.

In a Sept. 28 release, the Bureau of Economic Analysis estimated that the economy increased at an annual rate of 2.1% in the second quarter, and BEA revised its first quarter estimate upward to 2.2% from 2%.

The first official estimate for the third quarter of 2023 won’t be released until Oct. 26. But the Federal Reserve Bank of Atlanta’s “GDP Now” estimated on Oct. 18 that the economy will grow at an annual rate of 5.4% in the third quarter.

In a report released last month, Sal Guatieri, a senior economist at BMO Capital Markets, said the U.S. economy now seems poised for a “soft landing” — which is the sweet spot sought by the Fed when it raised interest rates with the hope that it would slow economic growth without causing a recession.

“We recently shifted to the soft-landing camp, as the broad strength shown in the Q2 GDP release convinced us that the U.S. economy is more durable than expected,” Guatieri writes. “Not only is it not slowing further, it might be picking up.”

Corporate Profits

As the fear of a recession fades, after-tax corporate profits increased in the second quarter of this year — the first increase in a year.

Under Biden, corporate profits set new annual records in 2021 and 2022 — but declined in the last two quarters of 2022 and the first quarter of this year, according to BEA estimates. (See line 45.)

On Sept. 28, the BEA estimated after-tax corporate profits were at an annual rate of more than $2.9 trillion in the second quarter. That was 22.6% higher than the quarter before Biden first entered the White House.

It was the first such increase since the second quarter of 2022.

Stephen Stanley, the chief economist at Santander Capital Markets US, told Bloomberg that the rise in corporate profits was due in part to companies that “saw a degree of relief on the cost side.”

!function(e,n,i,s){var d=”InfogramEmbeds”;var o=e.getElementsByTagName(n)[0];if(window[d]&&window[d].initialized)window[d].process&&window[d].process();else if(!e.getElementById(i)){var r=e.createElement(n);r.async=1,r.id=i,r.src=s,o.parentNode.insertBefore(r,o)}}(document,”script”,”infogram-async”,”

Consumer Sentiment

Despite improving economic trends, consumer confidence in the economy has fallen since our last report.

The University of Michigan’s Index of Consumer Sentiment dropped in the past two months. The October preliminary index was 63 — down from 68.1 in September and 71.6 in July.

The latest preliminary number was 16 points lower than it was when Biden took office in January 2021.

In a Sept. 8 report, Joanne Hsu, director of the Surveys of Consumers, said “while consumers have welcomed the slowdown in inflation in 2023, concerns over interest rates have emerged.”

Income and Poverty

Household income — Household income declined again during Biden’s second year in office.

According to Census Bureau estimates published in September, real median household income was $74,580 in 2022. When factoring in inflation, that was a decrease of $2,080, or 2.7%, from 2020.

It also was the third straight annual decrease, after median household income declined by $1,590 in 2020 and $330 in 2021.

(The median figure represents the midpoint — half of all households earned more, half less.)

Before 2020, real median income had reached $78,250 in 2019, the highest amount on record, according to the bureau’s inflation-adjusted figures.

Poverty — Meanwhile, the official poverty rate — which is based on an individual’s or family’s pretax cash income — went down by 0.1 percentage point, from 11.6% in 2021 to 11.5% in 2022, according to the Census Bureau’s most recent estimates. The 2022 rate was flat with the 2020 rate, which also was 11.5%.

As for the raw numbers, there were about 37.9 million people below the poverty line in 2022, which was about 370,000 more than in 2020.

However, the Census Bureau’s alternative estimate, the Supplemental Poverty Measure, showed an increase in poverty last year.

Unlike the official poverty rate, the SPM, which was introduced in 2011, factors in government programs that benefit low-income families and individuals, such as food, housing and energy assistance, as well as tax credits and stimulus payments. The SPM also considers other mandatory expenses and regional differences in the cost of living.

In 2022, the supplemental poverty rate was 12.4% — up from 7.8% in 2021, 9.2% in 2020 and 11.8% in 2019, before the pandemic. The 2022 rate “was the first significant increase in the SPM rate since 2010,” Census said.

And that increase, according to Census economists, “was largely the result of the end of stimulus payments and tax credits in effect during the COVID-19 pandemic that had lowered the SPM rate to its lowest level ever in 2021.”

Children, out of all age groups, were most affected by the expiration of those pandemic-related benefits, which included a one-year expansion of the child tax credit in 2021. The SPM child poverty rate increased by 7.2 percentage points, from 5.2% in 2021 to 12.4% in 2022, according to the poverty report.

Biden has said he will “fight to restore the expanded Child Tax Credit” that congressional Republicans opposed reauthorizing. Census said that the fully refundable child tax credit had prevented about 5.3 million children from falling into poverty in 2021, “over twice as many” people as the pared back version did in 2022.

Health Insurance

The number of people without health insurance has decreased by 0.7 percentage points or 2.4 million people under Biden. Those figures come from the Census Bureau’s annual reports, which measure those who lacked insurance for the entire year.

In 2020, the year before Biden took office, 28.3 million people, or 8.6% of the population, lacked health insurance for the entire year. In 2022, 25.9 million people, or 7.9% of the population, didn’t have insurance, according to the Census Bureau reports, which are typically published in September.

Another government survey, the Centers for Disease Control and Prevention’s National Health Interview Survey, measures the uninsured at the time they were interviewed, and by that metric, the drop is greater. The NHIS shows those without health insurance declined by 1.3 percentage points, or 4 million people, from 2020 to 2022.

More recent estimates from the NHIS indicate the share of the population without insurance continued to go down in the first three months of 2023. But as we have noted before, it’s possible the uninsured figures will go up this year, since some Medicaid provisions that were enacted during the coronavirus pandemic started to be phased out at the end of March.

The Census Bureau’s annual reports show that most Americans have insurance through their employers — 54.5% in 2022, a figure that has remained relatively steady under Biden. The main areas of growth in coverage, on a percentage basis, include: Medicaid, which enrolled 18.8% of the population in 2022, up 1 percentage point from 2020; Medicare, which covered 18.7% of the population, up 0.3 percentage points; and the Affordable Care Act marketplaces, which covered 3.6% of Americans, also up 0.3 percentage points.

Oil Production and Imports

Crude oil production averaged roughly 12.5 million barrels per day during Biden’s most recent 12 months in office (through July), according to Energy Information Administration data released in late September. That was almost 10.7% higher than the average daily amount of crude oil produced in 2020.

The U.S. is currently headed for a record production year, as the EIA, in its October Short-Term Energy Outlook report, projected that crude oil production would average over 12.9 million barrels per day in 2023 — higher than the more than 12.3 million barrels per day in 2019.

The EIA says higher well activity and higher oil prices have contributed to the increase in production, particularly in the Permian Basin region in eastern New Mexico and western Texas.

Despite the increased output, however, U.S. imports of crude oil still averaged more than 6.3 million barrels per day over the same 12-month period — up 7.4% from average daily imports in 2020.

Carbon Emissions

Since our last update, there was another small decline in U.S. carbon dioxide emissions.

In the most recent 12 months on record (ending in June), there were approximately 4.83 billion metric tons of emissions from the consumption of coal, natural gas and various petroleum products, according to the EIA. That’s down from the 4.88 billion metric tons as of our last report, but it’s still about 5.5% more than the 4.58 billion metric tons emitted in 2020.

In its October forecast, EIA projected that total energy-related emissions in 2023 would drop to 4.75 billion metric tons — which would be lower than the amounts in 2021 and 2022.

Home Prices & Homeownership

Home prices — Home prices fell since our last report, peaking in June and declining ever since.

The preliminary median sales price of existing single-family homes in the U.S. was $399,200 in September, marking the third straight month that prices have dropped, according to the National Association of Realtors.

!function(e,n,i,s){var d=”InfogramEmbeds”;var o=e.getElementsByTagName(n)[0];if(window[d]&&window[d].initialized)window[d].process&&window[d].process();else if(!e.getElementById(i)){var r=e.createElement(n);r.async=1,r.id=i,r.src=s,o.parentNode.insertBefore(r,o)}}(document,”script”,”infogram-async”,”

In its ongoing fight against inflation, the Federal Reserve raised its key interest rate in July for the 11th time since March 2022. As a result, mortgage rates have steadily increased and housing prices have cooled.

The 30-year fixed rate mortgage average nationwide, as of Oct. 19, was 7.63%, according to Freddie Mac.

“Not only are homebuyers feeling the impact of rising rates, but home builders are as well,” Sam Khater, Freddie Mac’s chief economist, said in an Oct. 19 press release. “Incoming data shows that the construction of new homes rebounded in September but as rates keep rising, home builders appear to be losing confidence. As a result, we expect construction to trend down in the short-term.”

Despite the recent dip, the median home price was nearly 30% higher in September than it was in January 2021, when Biden took office.

Homeownership — Homeownership rates have barely budged under Biden.

The homeownership rate, which the Census Bureau measures as the percentage of “occupied housing units that are owner-occupied,” was 65.9% in the second quarter of 2023 — a tick higher than the 65.8% rate during Trump’s last quarter in office. (Usual word of caution: The bureau warns against making comparisons with the fourth quarter of 2020, because of pandemic-related restrictions on in-person data collection.)

The rate peaked under Trump in the second quarter of 2020 at 67.9%. The highest homeownership rate on record was 69.2% in 2004, when George W. Bush was president.

Stock Markets

The stock markets dipped since our last report, plodding through the weakest quarter of the year. Overall, however, all three major indexes have increased value under Biden — although only modestly in some cases.

The S&P 500 stock index – which peaked for the year on July 31 and has been trending down since – was up 12.6% since Biden took office, as of the close of the markets on Oct. 19.

The Dow Jones Industrial Average, made up of 30 large corporations, has increased 8.0% under Biden. It peaked for the year on Aug. 1. The technology-heavy NASDAQ composite index, made up of more than 3,000 companies, crossed into positive territory under Biden in our last report. But a weak quarter now puts it down by less than 1%.

Refugees

As a candidate, Biden pledged to accept up to 125,000 refugees a year. The Biden administration fell far short of that lofty goal for the second straight fiscal year, but it is making some progress.

In fiscal year 2023, which ended Sept. 30, the U.S. accepted 60,014 refugees — the highest total since fiscal year 2016, which was the last full fiscal year of the Obama-Biden administration, according to State Department data. It was also more than twice as many as the 25,465 refugees admitted in fiscal 2022.

Overall, the U.S. has admitted 95,487 refugees in Biden’s first full 32 months in office, or 2,984 refugees per month, the data show. That’s about 62% higher than the 1,845 monthly average under Trump, who significantly reduced the admission of refugees. (For both presidents, the averages include only full months in office, excluding January in 2017 and 2021, when administrations overlapped.)

But, in order to reach Biden’s target of 125,000, the U.S. needs to admit about an average of 10,417 refugees per month. Under Biden, the peak month was 8,762 in September.

As it did in fiscal years 2023 and 2022, the administration has once again set the cap on refugee admissions at 125,000 for fiscal year 2024. In doing so, Secretary of State Antony Blinken said the Biden administration “has worked to rebuild, streamline, and expand the U.S. Refugee Admissions Program,” which the department has said was weakened by COVID-19 and a lack of resources under the Trump administration.

“Admitting 125,000 refugees — an ambitious target not achieved in three decades — is now within reach,” Blinken said, referring to 1992, when the Clinton administration set the cap at 131,000 and admitted 132,531, according to the data compiled by the Migration Policy Institute.

!function(e,n,i,s){var d=”InfogramEmbeds”;var o=e.getElementsByTagName(n)[0];if(window[d]&&window[d].initialized)window[d].process&&window[d].process();else if(!e.getElementById(i)){var r=e.createElement(n);r.async=1,r.id=i,r.src=s,o.parentNode.insertBefore(r,o)}}(document,”script”,”infogram-async”,”

Immigration

The number of apprehensions of those trying to cross the southern border illegally crept back up in July and August, to 132,648 and 181,059, respectively, according to the latest data from U.S. Customs and Border Protection. But that’s still lower than the apprehension figures between March and December 2022, when monthly numbers regularly topped 200,000.

“Irregular migrant arrival numbers seem to be going back up but do remain below the highs seen at the start of the fiscal year,” Colleen Putzel-Kavanaugh, an associate policy analyst at the Migration Policy Institute, told us.

“Looking at migration numbers through the Darien Gap and Central America it is clear that many people continue to be on the move, with their final destination possibly being the U.S.” Putzel-Kavanaugh said. “Irregular arrival numbers likely remain below the highs at the start of FY 2023 because of the new legal pathways available like the CBP One app and the parole programs for nationals of Cuba, Haiti, Nicaragua, and Venezuela.”

CBP One is a mobile app created by the Biden administration that allows migrants to make appointments to seek asylum (and penalizes those who do not).

On Sept. 20, the Department of Homeland Security announced a new “series of actions to increase enforcement across the Southwest Border, accelerate processing of work authorizations, and the decision to redesignate and extend Temporary Protected Status (TPS) for Venezuela.”

Biden also asked Congress for $4 billion in supplemental funding for enhanced border security. But ultimately, Biden said Congress needs to pass comprehensive immigration reform.

“As a result of Congress’ failure to enact the reform, the Administration has been using the limited tools it has available to secure the border and build a safe, orderly, and humane immigration system while leading the largest expansion of lawful pathways for immigration in decades,” DHS wrote.

Looking at the entirety of Biden’s time in office, and to even out the seasonal changes in border crossings, we compare the most recent 12 months on record with the year prior to him taking office. And for the past 12 months ending in August, the latest figures available, apprehensions totaled 2,034,730, according to Customs and Border Protection. That’s 300% higher than during Trump’s last year in office.

“Demand to enter the U.S. remains high and the options for legal entry, though vastly expanded, are still limited, which likely contributes to continued high numbers of irregular migrant arrivals,” Putzel-Kavanaugh said.

Food Stamps

Enrollment in the Supplemental Nutrition Assistance Program, or SNAP, declined each month since our last update. The program used to be known as food stamps.

As of July, nearly 41.3 million people were receiving food assistance, the lowest monthly enrollment since August 2022. That figure is down about 1.5 million people from this year’s high of nearly 42.8 million in January, and it’s a decrease of about 2%, or 856,143 people, from when Biden became president in January 2021.

The figures, which are preliminary, come from Department of Agriculture data updated this month.

Despite the recent declines, the number of SNAP beneficiaries in July was still higher than the 40.8 million on the rolls in August and September 2021, which was the lowest participation under Biden.

Debt and Deficits

Debt — Since our last quarterly update, the public debt, which excludes money the government owes itself, increased by more than $783 billion to over $26.5 trillion, as of Oct. 17. That brings the total increase during Biden’s presidency to roughly $4.9 trillion, which is 22.5% higher than it was when Biden took office.

Deficits — In its Monthly Budget Review for September, the Congressional Budget Office estimates that the federal deficit rose to nearly $1.7 trillion in fiscal year 2023, which ended on Sept. 30. That’s up about 23% from the nearly $1.4 trillion in fiscal year 2022, but still down 46% from the deficit of $3.1 trillion in fiscal year 2020.

The Treasury Department is expected to release its finalized deficit figure for fiscal 2023 this month.

Compared with fiscal 2022, CBO said that both revenues and spending were lower in fiscal 2023, but receipts were down by $455 billion, or 9%, compared with a decrease of $141 billion, or 2%, in outlays.

Guns

Handgun production — In 2022, annual production of pistols and revolvers in the U.S. totaled just under 7 million, according to figures in an interim report prepared in July by the Bureau of Alcohol, Tobacco, Firearms and Explosives.

That is an increase of about 7.3% from 2020, when handgun production during the beginning of the pandemic surged to a then-record of over 6.5 million. The 2022 figure, if it holds, also would be an 11.8% decrease from the final 2021 figure of over 7.9 million.

Prior to 2020, handgun production had gone down by more than a third under Trump through 2019. That was after production more than tripled during President Barack Obama’s time in office.

!function(e,n,i,s){var d=”InfogramEmbeds”;var o=e.getElementsByTagName(n)[0];if(window[d]&&window[d].initialized)window[d].process&&window[d].process();else if(!e.getElementById(i)){var r=e.createElement(n);r.async=1,r.id=i,r.src=s,o.parentNode.insertBefore(r,o)}}(document,”script”,”infogram-async”,”

Gun sales — The National Shooting Sports Foundation’s latest estimates suggest that gun purchases continued to decline during the third quarter of 2023.

Since the federal government doesn’t collect data on gun sales, the NSSF, a gun industry trade group, estimates gun sales by tracking the number of background checks for firearm sales based on the FBI’s National Instant Background Check System, or NICS. The NSSF-adjusted figures exclude background checks unrelated to sales, such as those required for concealed-carry permits.

The group’s adjusted NICS total for background checks during the third quarter of the year was over 3.28 million. That’s a nearly 12.8% drop from the roughly 3.76 million in the third quarter of 2022, and it’s also down close to 42% from the almost 5.63 million in Trump’s last full quarter in 2020.

Through the first nine months of 2023, there were about 11.11 million background checks for firearm sales. That total is down 28% from the same period in 2020, down 19% from 2021 and down 6.6% from 2022 — which were the years with the first, second and third highest annual totals, respectively.

Trade

The international trade deficit is down from last year’s record high, but still up compared with Trump’s final year.

According to Bureau of Economic Analysis figures published this month, the U.S. imported approximately $813.6 billion more in goods and services than it exported over the last 12 months through August. That’s an increase of more than $106.7 billion, or 24.6%, compared with 2020.

But through the first eight months of 2023, the trade gap in goods and services was down $137.6 billion, or 20.7%, from the same period in 2022. Exports increased $22 billion, or 1.1%, and imports decreased $115.6 billion or 4.3%, the BEA said.

The U.S. is currently on pace to have an annual trade deficit that is lower than the record of $951.2 billion in 2022 and the second-highest gap of $841.6 billion in 2021.

Judiciary Appointments

Supreme Court — So far, Biden has won confirmation for one Supreme Court justice, Ketanji Brown Jackson. She replaced retired Justice Stephen G. Breyer, an appointee of President Bill Clinton, and was confirmed on April 7, 2022. By this same point during Trump’s term, he had won confirmation for two Supreme Court justices.

Court of Appeals — Biden also has won confirmation for 36 U.S. Court of Appeals judges. At the same point under Trump, 43 had been confirmed.

District Court — For District Court confirmations, 110 judges have been confirmed under Biden, while 109 had been confirmed at the same point during Trump’s presidency.

Biden has now won confirmation for four U.S. Court of Federal Claims judges. At this point under Trump, two such judges had been confirmed, as well as two U.S. Court of International Trade judges.

As of Oct. 19, there were 68 federal court vacancies, with 28 nominees pending.

Editor’s note: FactCheck.org does not accept advertising. We rely on grants and individual donations from people like you. Please consider a donation. Credit card donations may be made through our “Donate” page. If you prefer to give by check, send to: FactCheck.org, Annenberg Public Policy Center, 202 S. 36th St., Philadelphia, PA 19104.

Sources

U.S. Bureau of Labor Statistics. “Employment, Hours, and Earnings from the Current Employment Statistics survey (National): Total Nonfarm.” Accessed 8 Oct 2023.

U.S. Bureau of Labor Statistics. “Labor Force Statistics from the Current Population Survey: Unemployment.” Accessed 8 Oct 2023.

U.S. Bureau of Labor Statistics. “Job Openings and Labor Turnover Survey: Job Openings.” Accessed 8 Oct 2023.

U.S. Bureau of Labor Statistics. “Labor Force Statistics from the Current Population Survey: Labor Force Participation Rate.” Accessed 8 Oct 2023.

U.S. Bureau of Labor Statistics. Monthly Labor Review. “Projections overview and highlights, 2021–31” Nov 2022.

U.S. Bureau of Labor Statistics. “Employment, Hours, and Earnings from the Current Employment Statistics survey (National): Manufacturing.” Accessed 8 Oct 2023.

U.S. Bureau of Labor Statistics. “Consumer Price Index – All Urban Consumers (Seasonally Adjusted).” Data extracted 10 Oct 2023.

U.S. Bureau of Labor Statistics. Consumer Price Index Summary. News release. 13 Jul 2022.

U.S. Energy Information Administration. “Weekly U.S. Regular All Formulations Retail Gasoline Prices.” Data extracted 17 Oct 2023.

U.S. Bureau of Labor Statistics. “Employment, Hours and Earnings from the Current Employment Statistics survey (National); Average Weekly Earnings of Production and Nonsupervisory Employees, total private.” Data extracted 10 Oct 2023.

U.S. Bureau of Labor Statistics. “Employment, Hours and Earnings from the Current Employment Statistics survey (National); Average Weekly Earnings of Production and Nonsupervisory Employees, 1982-1984 dollars, total private.” Data extracted 10 Oct 2023.

State Department. “Presidential Determination on Refugee Admissions for Fiscal Year 2022.” 8 Oct 2021.

“The Biden Plan for Securing Our Values as a Nation of Immigrants.” Biden campaign. Undated, accessed 18 Jan 2022.

State Department. “Refugee Admissions Report.” 30 Sep 2023.

White House. “Presidential Determination on Refugee Admissions for Fiscal Year 2023.” 27 Sep 2022.

State Department. “Presidential Determination on Refugee Admissions for Fiscal Year 2024.” 29 Sep 2023.

State Department. “Report to Congress on Proposed Refugee Admissions for Fiscal Year 2022.” 20 Sep 2021.

“U.S. Annual Refugee Resettlement Ceilings and Number of Refugees Admitted, 1980-Present.” Migration Policy Institute. Updated, accessed 6 Oct 2023.

Federal Reserve Bank of Atlanta. “GDP Now.” 18 Oct 2023.

U.S. Bureau of Economic Analysis. “Table 1.1.1. Percent Change From Preceding Period in Real Gross Domestic Product.” Accessed 18 Oct 2023.

The Conference Board. “US recession probability reaches 96 percent heading into Q4.” 29 Sep 2022

U.S. Bureau of Economic Analysis. “Gross Domestic Product (Third Estimate), Corporate Profits (Revised Estimate), Second Quarter 2023 and Comprehensive Update.” 28 Sep 2023.

BMO Economics. “North American Outlook: Sticking the (Soft) Landing.” 11 Sep 2023.

Boocker, Sam and David Wessel. “What is a soft landing?” 14 Sep 2023.

University of Michigan Surveys of Consumers. “Preliminary Results for October 2023.” Accessed 16 Oct 2023.

University of Michigan Surveys of Consumers. “The Index of Consumer Sentiment.” Accessed 16 Jan 2023.

US Census Bureau. “Business and Industry: Homeownership rates.” Accessed 7 Jul 2023.

Mateyka, Peter, and Mazur, Christopher. “Homeownership in the United States: 2005 to 2019.” US Census Bureau. Mar 2021.

U.S. Census Bureau. “Quarterly Residential Vacancies And Homeownership, Fourth Quarter 2021.” 2 Feb 2022.

U.S. Census Bureau. “Time Series/Trend Charts: Not Seasonally Adjusted Home Ownership Rate.” Accessed 11 Oct 2023.

U.S. Bureau of Economic Analysis. “National Income by Type of Income.” 28 Sep 2023.

Boesler, Matthew. “US Corporate Profits Rise Again With Recession Fear Fading.” 30 Aug 2023.

National Association of Realtors. “Sales Price of Existing Single-Family Homes.” Undated, accessed 19 Oct 2023.

National Association of Realtors. “Sales Price of Existing Single-Family Homes.” Undated, accessed 19 Oct 2023.

“Mortgage Rates Approach Eight Percent.” Press release. Freddie Mac. 19 Oct 2023.

Yahoo! Finance. “Dow Jones Industrial Average.” Accessed 19 Oct 2023.

Yahoo! Finance. “S&P 500.” Accessed 19 Oct 2023.

Yahoo! Finance. “NASDAQ Composite.” 19 Oct 2023.

U.S. Customs and Border Protection. Southwest Land Border Encounters. Accessed 19 Oct 2023.

Guzman, Gloria and Melissa Kollar. “Income in the United States: 2022.” Census Bureau. 12 Sep 2023.

Creamer, John, et. al. “Poverty in the United States: 2022.” Census Bureau. 12 Sep 2023.

Dealer Wire. “NSSF-Adjusted NICS Background Checks for July 2023.” 4 Aug 2023

Dealer Wire. “NSSF-Adjusted NICS Background Checks for August 2023.” 8 Sep 2023.

Dealer Wire. “NSSF-Adjusted NICS Background Checks for September 2023.” 6 Oct 2023.

U.S. Department of Agriculture. Supplemental Nutrition Assistance Program. Persons, Households, Benefits, and Average Monthly Benefit per Person & Household. 13 Oct 2023, accessed 18 Oct 2023.

U.S. Bureau of Economic Analysis. U.S. Trade in Goods and Services, 1960-present. 5 Oct 2023, accessed 18 Oct 2023.

U.S. Bureau of Economic Analysis. “U.S. International Trade in Goods and Services, August 2023.” 5 Oct 2023.

U.S. Energy Information Administration. U.S. Field Production of Crude Oil. Accessed 16 Oct 2023.

U.S. Energy Information Administration. U.S. Imports of Crude Oil. Accessed 16 Oct 2023.

U.S. Energy Information Administration. “Monthly Energy Review, September 2023.” Table 11.1 Carbon Dioxide Emissions From Energy Consumption by Source. 26 Sep 2023.

U.S. Energy Information Administration. “Short-Term Energy Outlook October 2023.” 11 Oct 2023.

Congressional Budget Office. “Monthly Budget Review: September 2023.” 10 Oct 2023.

U.S. Department of Treasury. Debt to the Penny. Accessed 18 Oct 2023.

Keisler-Starkey, Katherine et. al. “Health Insurance Coverage in the United States: 2022.” Census Bureau. Sep 2023.

Keisler-Starkey, Katherine et. al. “Health Insurance Coverage in the United States: 2021.” Census Bureau. 13 Sep 2022.

Tolbert, Jennifer and Meghana Ammula. “10 Things to Know About the Unwinding of the Medicaid Continuous Enrollment Provision.” Kaiser Family Foundation. 5 Apr 2023.

Centers for Disease Control and Prevention; National Health Interview Survey. “Health Insurance Coverage: Early Release of Estimates From the National Health Interview Survey, 2022.” May 2023.

Centers for Disease Control and Prevention; National Health Interview Survey. “Health Insurance Coverage: Early Release of Quarterly Estimates From the National Health Interview Survey, January 2022–March 2023.” Aug 2023.

Major Cities Chiefs Association. Violent Crime Survey – National Totals. Midyear Comparison January 1 to June 30, 2023 and 2022. 17 Aug 2023.

Major Cities Chiefs Association. Violent Crime Survey – National Totals. Year End Comparison January 1 to December 31, 2022, and 2021. 10 Feb 2022.

Major Cities Chiefs Association. Violent Crime Survey – National Totals. Year End Comparison January 1 to December 31, 2021, and 2020. 10 Feb 2022.

Major Cities Chiefs Association. Violent Crime Survey – National Totals. Year End Comparison January 1 to December 31, 2020, and 2019. updated 14 Feb 2022.

FBI. “FBI Releases 2022 Crime in the Nation Statistics.” Press release. 16 Oct 2023.

FBI. “UCR Summary of Crime in the Nation, 2022.” 2023.

FBI. Table 1, Crime in the United States, 2022. Accessed 19 Oct 2023.

Lopez, Ernesto et. al. “Crime Trends in U.S. Cities: Mid-Year 2023 Update.” Council on Criminal Justice. Jul 2023.

United States Courts. Confirmation Listing, Judicial Confirmations for January 2023, 117th Congress. Updated 1 Jan 2023.

United States Courts. Confirmation Listing, Judicial Confirmations, 118th Congress. updated 18 Oct 2023.

United States Courts. Current Judicial Vacancies, 118th Congress. updated 19 Oct 2023.

United States Courts. Confirmation Listing, Judicial Confirmations for January 2019, 115th Congress. updated 1 Jan 2019.

United States Courts. Confirmation Listing, Judicial Confirmations for November 2019, 116th Congress. updated 1 Nov 2019.